A bank overdraft is where the bank pre-approves a limit for you to spend when you have no more funds in your bank account. It's a credit facility that many businesses rely on when unexpected expenses crop up, keeping cash flowing.

Limits can range from £1,000 to upwards of £50,000. And what limit you're pre-approved for depends on your circumstances and credit history.

Many businesses regularly dip into their overdraft, particularly those in food or manufacturing industries where upfront costs are higher. But, with high fees and tight repayment terms, there are plenty of overdraft alternatives offering a more cost-effective way to manage business cash flow and sustain growth.

Here, we're exploring some of the most popular business bank overdraft alternatives.

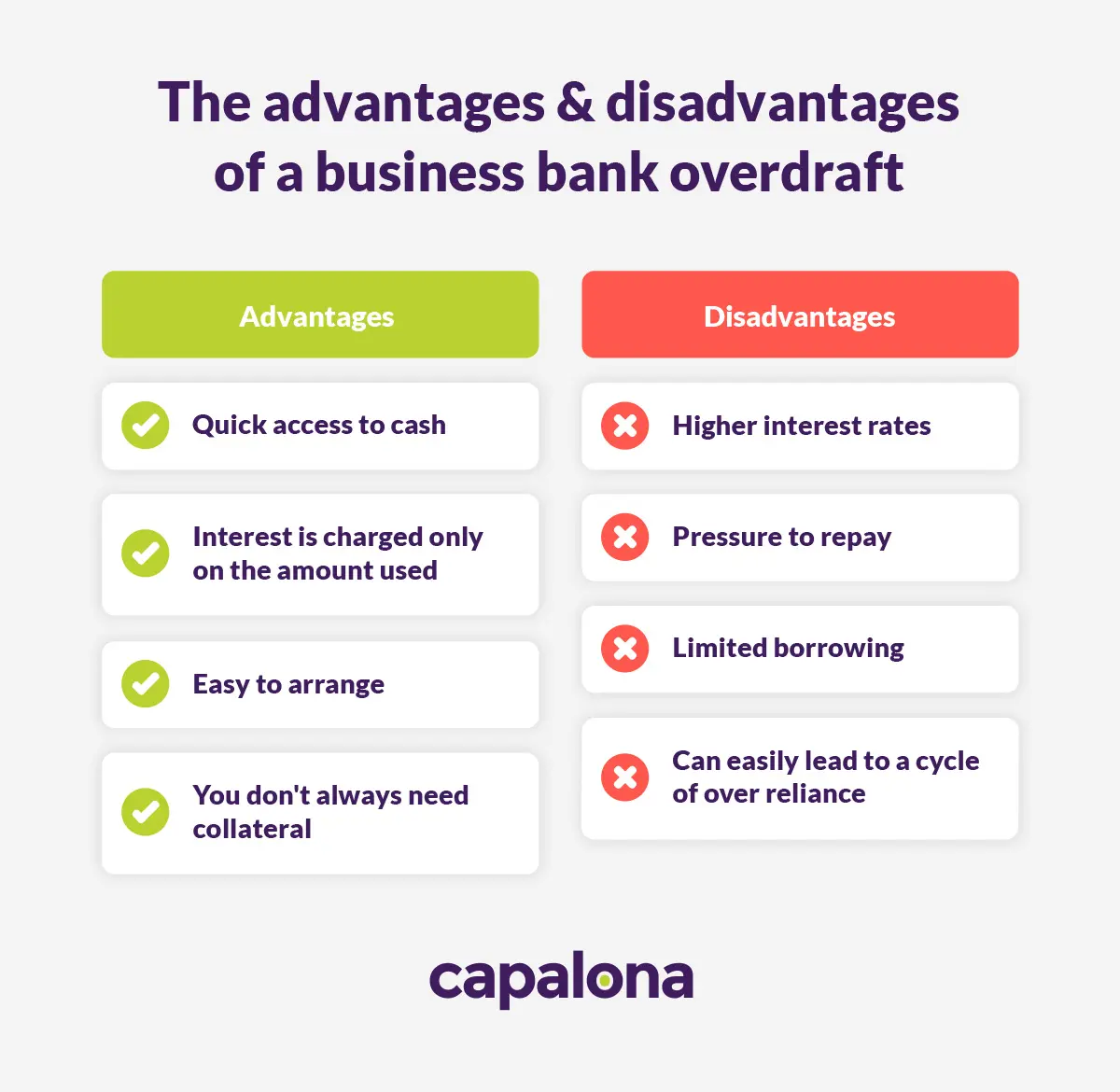

Bank Overdrafts - Advantages and Disadvantages for Business

Choosing any kind of business funding can be overwhelming. With so many types to choose from, how do you know if an overdraft is the best for you?

Here are some pros and cons of overdrafts to help you make a more balanced decision.

Advantages of a business bank overdraft

- Quick and easy access to funds — a business overdraft provides convenient access to funds for smaller or unexpected expenses or cover short-term gaps in your business’s cash flow. To access a bank overdraft, you must first open a business bank account.

- Interest is charged only on the amount used — whatever you draw down, you pay interest on, so if you don't touch it, you don't pay interest, unlike a bank loan, where the entire amount will need to be repaid with interest.

- Easy to arrange — if eligible for an overdraft, it can be very quick to arrange. Usually, you only have to opt in, and the money can be available immediately.

- You don't always need collateral — most overdrafts don’t require collateral, so if you're a start-up business or you want to access capital without risking an asset, a bank card overdraft can be a great option.

Disadvantages of a business bank overdraft

- Higher interest rates — Most high street banks offering overdrafts charge higher interest rates to borrowers than they do for traditional business loans.

- Pressure to repay — If you don’t repay your balance in full within the month, you face higher interest rates. This means the stress can easily become overwhelming, particularly if you regularly rely on your overdraft to pay essential business expenses.

- Limited borrowing — if you want to invest significantly in your small business, an overdraft might not be the most cost-effective way to do it. Although you might be able to access reasonably high overdraft limits, borrowing like this is not a long-term solution. In these cases, you're best applying for a business loan.

- False sense of security — you can easily find yourself stuck in a cycle of relying on your overdraft to make payments. But this isn't the best way to make complete use of your budget. With variable interest rates changing frequently, you can never 100% predict your outgoings each month, making it difficult to plan. Steady cash flow is essential for healthy business growth, so move away from this false sense of security if you can and consider other business finance options.

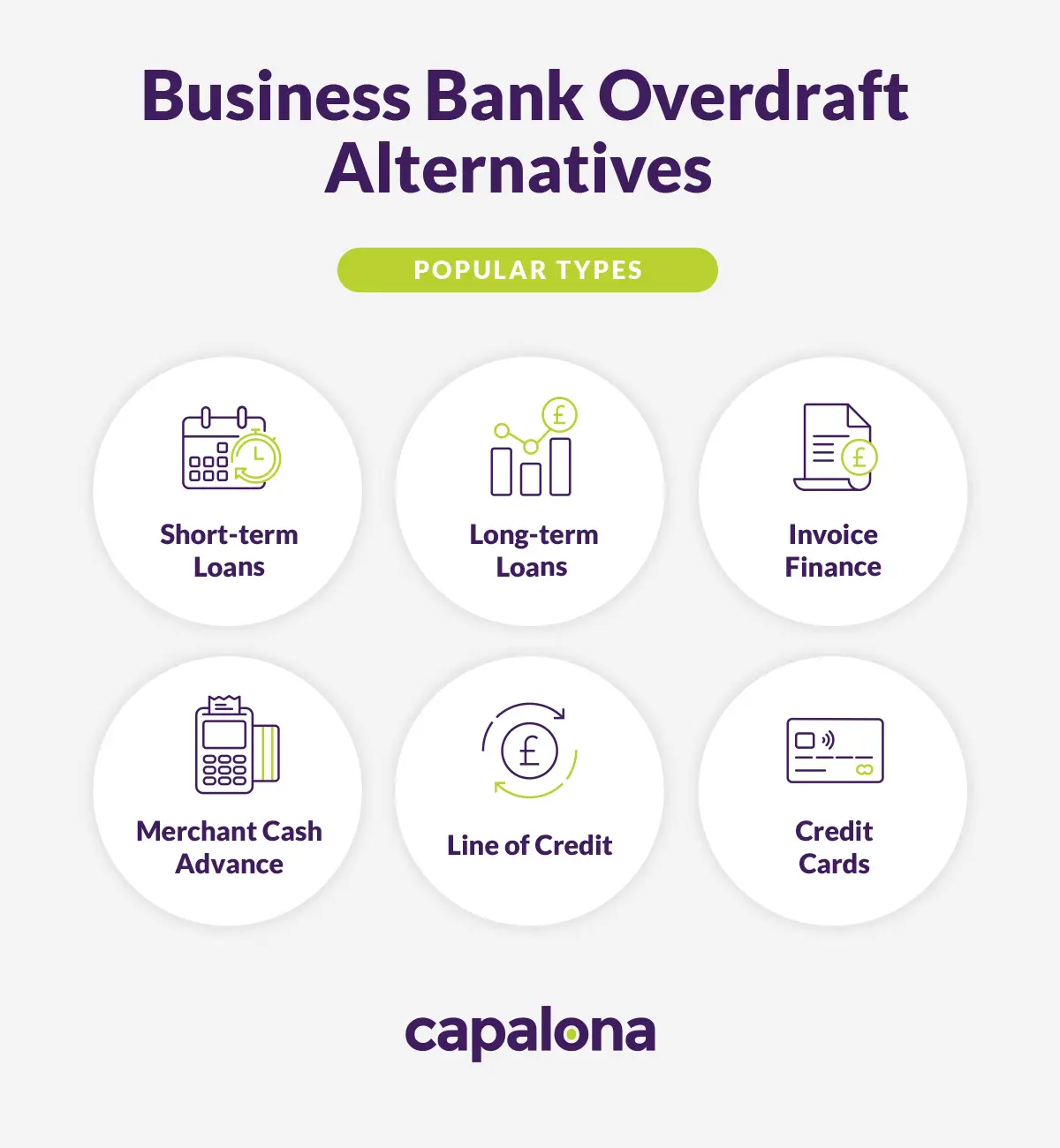

Alternatives to using a business bank overdraft

If you’re wondering about your other business finance options, we’re exploring some of the most popular ones.

Short-term loans

Applying for a short-term business loan is an alternative to business overdrafts that gives you a lump sum straight into your business bank account. You'll repay this loan, with interest, over a short period, usually within 12 months to three years. Loans usually have lower interest rates than overdrafts as you're repaying over a longer period than your overdraft grants you. In some cases you may be able to get your business loan on the same day.

Long-term loans

As you'd expect, long-term business loans are repaid over a longer period, with some lenders offering repayment periods in excess of 10 years. To secure a long-term loan, you'll usually need to secure it with collateral, i.e., commercial property, sign a personal guarantee, or use a guarantor on your application. So, if your business growth plans require substantial investment, you could consider a long-term loan instead of an overdraft.

Invoice financing

If you invoice customers, you can access up to 95% of that unpaid invoice amount instantly with invoice finance. That means no waiting around for 30, 60 or 90 days for the customer to pay in full.

This solution helps you obtain an advance on the money you're owed instead of dipping into your overdraft to access funds. Once the customer pays in full, lender fees are deducted from the final invoice balance. It is a great way to restore healthy cash flow quickly—choose to sell one or multiple invoices whenever you need access to funds.

Merchant cash advance

If you take credit or debit card payments and turnover at least £2,500 in card sales each month, you could be eligible for a merchant cash advance. A cash advance is based on your future predicted sales, so the lender will analyse your past sales to agree on what to lend you, but you could access as much as £300,000. Then, repay as a percentage to keep loan repayments in line with your monthly revenue — much less stressful than repaying your overdraft within the month to avoid high fees.

Line of credit

A flexible business line of credit can be both revolving (like an overdraft) and non-revolving. You can draw down funds as and when you need them and only pay interest on the money you use. The interest with a line of credit is usually lower than the fees associated with an overdraft, and you and the lender agree on a term length, so as long as you repay the full amount by the agreed date, you can repay whenever you like.

Business credit card

Although business credit cards don’t necessarily offer the most competitive interest rates, the rates you can access are usually lower than bank overdraft rates. New customers can typically find great introductory offers when opening a business credit card, taking advantage of interest-free periods and other perks, including cashback or free travel insurance.

Looking for the best alternative to a bank overdraft? We can help you find and compare lenders in seconds with our FREE business loan comparison tool. Tell us how much you want to borrow, and we’ll instantly match you with eligible UK lenders. Get a quote now.