APR is an essential measure of the cost of a financial product. So, If you've heard the term and wondered what it is and why it's important, this guide will tell you everything you need to know about it.

What is APR?

An annual percentage rate or APR shows the total annual cost of borrowing a loan or taking out a credit card. The APR includes both the interest rate and any associated compulsory costs with borrowing, e.g. annual fees and processing fees.

"Typical" APR refers to the average or estimated APR for a type of loan or specific lender. The true APR you would need to pay may differ.

How does APR work?

APR represents the interest rate and other associated costs as a percentage. This offers prospective borrowers a standardised way to compare the cost of financial products, helping them make an informed lending decision.

An example of APR

Let's say you borrow £4,000 on a business credit card, and the annual percentage rate is 24%; the total cost of borrowing is £4,000 + 24% = £4,960.

If this repayment was in monthly instalments, you'll pay roughly £413 monthly. Note this cost wouldn't include any late fees.

What is representative APR?

Representative APR is a rate at least 51% of borrowers will receive. So, although the APR isn't the same for everyone because it depends on your financial circumstances, you can take the annual percentage rate shown as a good example of what annual loan costs to expect.

Fixed Vs variable APRs

When taking out a business loan or credit card, the lender will either charge a fixed or variable APR. A fixed APR means the annual percentage rate remains static for the duration of the loan term. But a variable APR is subject to market fluctuations. Variable APR can change with immediate effect, whereas a fixed APR requires notice of at least 45 days.

And although variable APRs usually start lower than the fixed APR, always consider whether you can comfortably afford to repay your loan should the market conditions dictate a higher annual percentage rate.

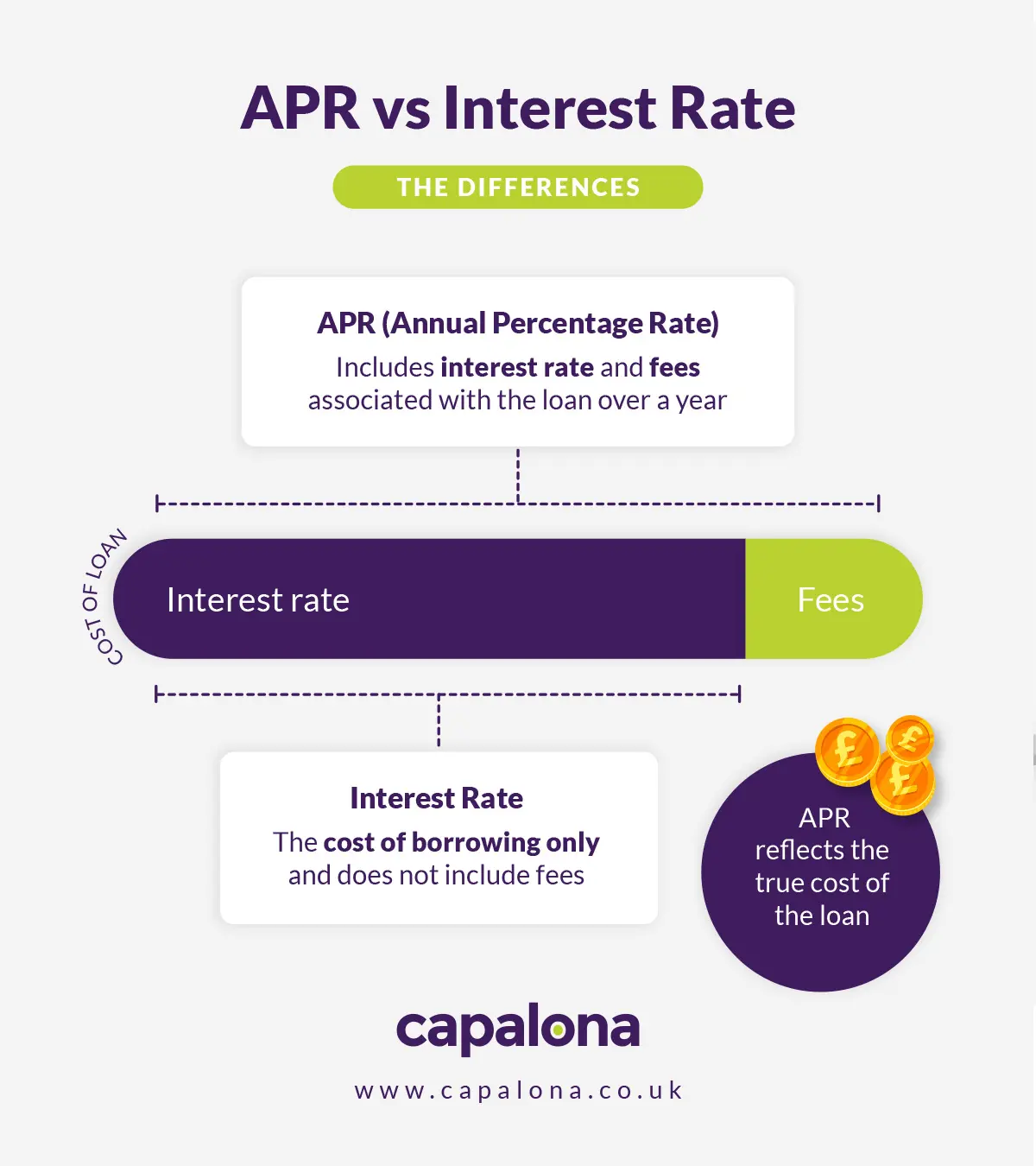

APR Vs interest rates: what's the difference

An interest rate is a basic cost of borrowing money from the lender and is represented by a percentage. An interest rate will usually be lower than the APR. The APR is an annual percentage that includes the interest rate plus other associated costs and provides a more accurate estimate of the cost of borrowing.

What's a good APR?

The lower the annual percentage rate, the cheaper the cost of borrowing. The national APR average in the UK for credit cards is 35.55%, so anything lower than this is considered a competitive APR.

If you're applying for an unsecured business loan, an annual percentage rate between 7-20% is relatively average in the UK. When searching for personal loans, watch out for payday loans in particular; some loans offer an APR of 1,500%.

How to access a low APR loan

Ultimately, to unlock the lowest rates, you need an excellent credit score. So, if your score is poor, you can take steps to improve your credit.

Other ways to ensure you're getting the best APR include:

- Comparing products on the market. Knowing what's out there means you can make a balanced decision on which financial product suits your needs best.

- Consider balance transfers. By transferring the balance of your credit card to another provider, you can access better rates.

- Negotiate with your lender. It's worth contacting your lender directly to see if they can offer you better rates — particularly if you have a reliable repayment history.

Comparing APRs

If you're looking to access alternative business funding, you should first start by comparing eligible options.

Comparing lenders and products helps you make a balanced decision. It's not just APR you should compare; it's helpful to see loan products side-by-side to ensure you choose the right loan or business credit card for your business needs.

For example, one loan might have a slightly higher annual percentage rate than the other, but you can borrow more money from one lender, which might be more beneficial to your ambitious growth plans.

How Capalona can help:

- Quick and easy loan comparison

- Compare total repayable, interest rates and more instantly

- It's free to get a quote with no obligation to proceed

- Getting a quote won't affect your credit score