If you’ve got family and friends willing to lend you money, it can remove the hassle of lengthy loan applications, but it also comes with some drawbacks. Read on to learn more.

What is a friends and family loan?

A loan from a family member or a friend is when they lend you a sum of money, and you repay them over a pre-agreed period. Lending money like this has many advantages and disadvantages.

Whether you ask your friends and family for a loan may depend on several factors. Keep reading to learn more.

Advantages of a friends and family loan

Low or no interest to pay

You'll have to pay interest when applying for a loan through a lender or high street bank. This increases the total amount of the loan, subsequently increasing your monthly repayments. When borrowing money from friends or relatives, they can set their own interest rates, making it substantially cheaper to borrow this way.

This type can be known as a soft loan, and depending on who you’re borrowing from, you might not have to pay any interest. So it’s an option worth considering to keep more cash in the business.

Quick access to cash

Borrowing from family or friends is much quicker than applying for a traditional loan. If your family member has the money sitting in a bank account, all they have to do is transfer the funds, and you can start spending. There are no lengthy loan applications, no formal credit checks, and no barriers to getting those funds, which means you can start your business quickly.

Flexible loan repayment

With an unsecured loan, you can have up to five years to repay, but with a loan from family or friends, you can set a repayment schedule that suits you both. That might be over 10+ years. Or you might not even have to repay it all — your relative might consider part of it an investment into your business.

Disadvantages of a friends and family loan

You’re limited to what you can borrow

How much you can borrow depends on how much your relatives can lend you. They might be able to lend £5,000, but if you need to borrow more to invest in new opportunities, bulk-buy stock or start a business from scratch, you can’t access any more funds. But if you apply for revolving credit, like a business line of credit or a business credit card, you can continue to access money.

You can damage your relationship

If you fail to make the agreed repayments, you could put your family member in financial trouble and affect their creditworthiness. Or if the relative fails to give you the amount agreed upon, it can cause unnecessary tension in your relationship.

You have to question whether it’s worth jeopardising your relationship for a business loan.

How to borrow money from friends and family

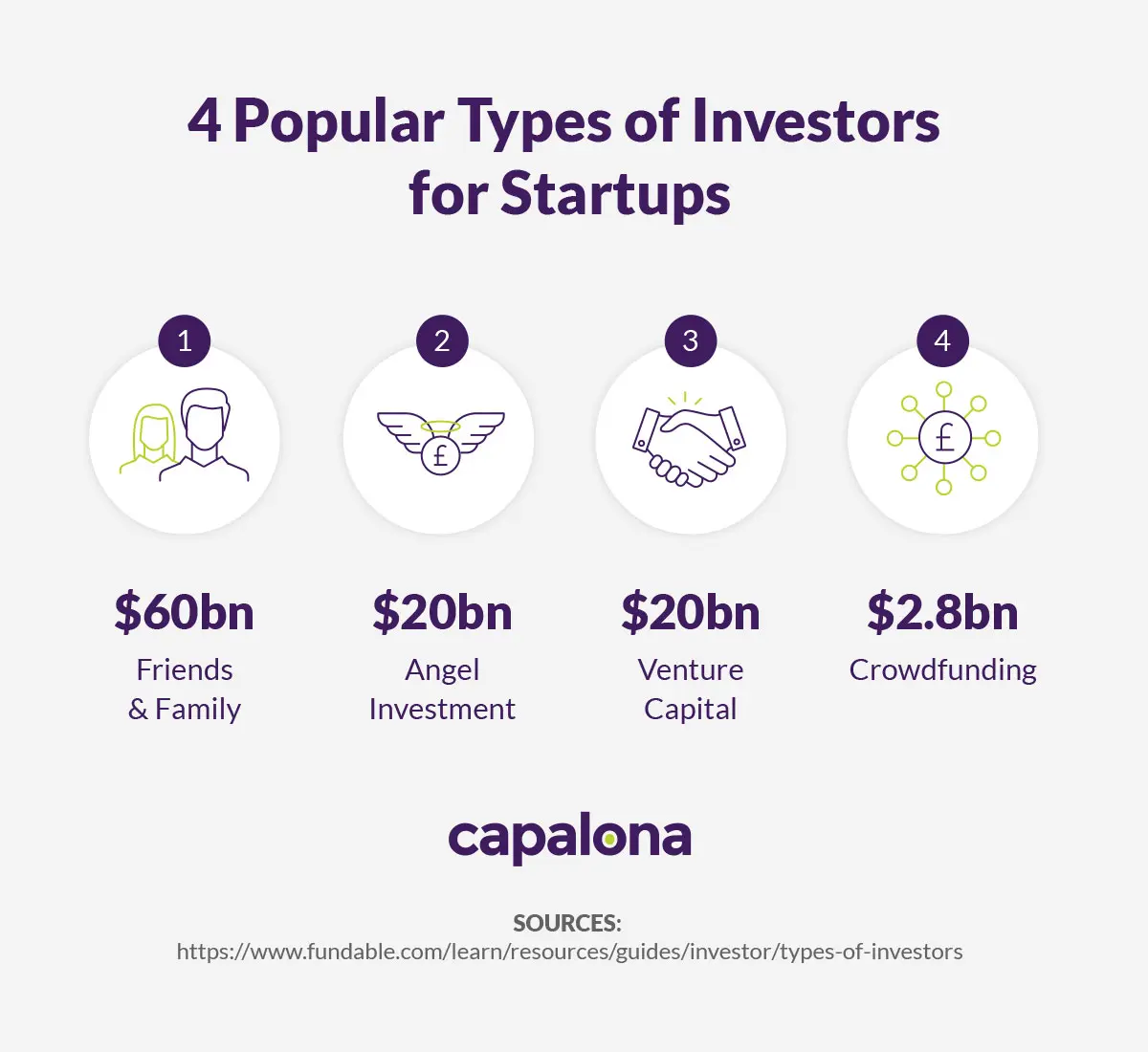

Asking for money from loved ones can be a challenging conversation to have. But you’re not alone in approaching family and friends for business finance. According to Fundable, 38% of startup founders raised money from family and friends.

So it’s still a popular way to access the funds you might need to start your business — you just need to work out whether the pros outweigh the cons.

Here’s some advice when borrowing from family and friends:

- Be transparent from the outset - Set out how much you’re looking to borrow, what you’re planning on spending it on, and how quickly you can realistically repay their money.

- Draw up a formal repayment plan - In your agreement, state how much you’re borrowing and lay out a plan to repay, including how much each month you’ll pay back, plus interest if necessary and don’t forget to outline any terms.

- Respect your family or friends’ decision - if they don’t want to lend you money or they want to lend you a smaller amount than you were looking for.

Alternatives to a family and friend loan

If you’re not sure whether you’d like to mix family with business, there are plenty of business financing options to help you grow your business quickly or start a brand new business — here are just a few to consider:

Secured and unsecured loans

Business loans are one of the most common types of business finance. They’re relatively straightforward, with the borrower applying to a direct lender, getting approval, having funds deposited in their bank account, and repaying the loan with interest monthly.

Business credit card

Applying for a credit card for your business is quick and easy, and many come with interest-free periods. So there’s more flexibility when paying back the funds you use in your business. As a revolving credit facility, a credit card can be useful for emergencies or other unexpected business expenses, such as increased rent and energy bills.

If a small business loan from friends and family isn’t a viable option, you can use our free loan comparison tool to find and compare the best loan rates. Compare SME loans now.