If you want to grow your business, you might want to invest in a new marketing strategy, bulk-buy popular products or enter new markets. But for that to happen, you need funds. To access these funds, you have two options: internal or external finance.

So, if you’re wondering what the differences between internal and external finance sources are or which option is best for you, keep reading as we explore their advantages and disadvantages to help you make a balanced decision.

What are internal sources of finance?

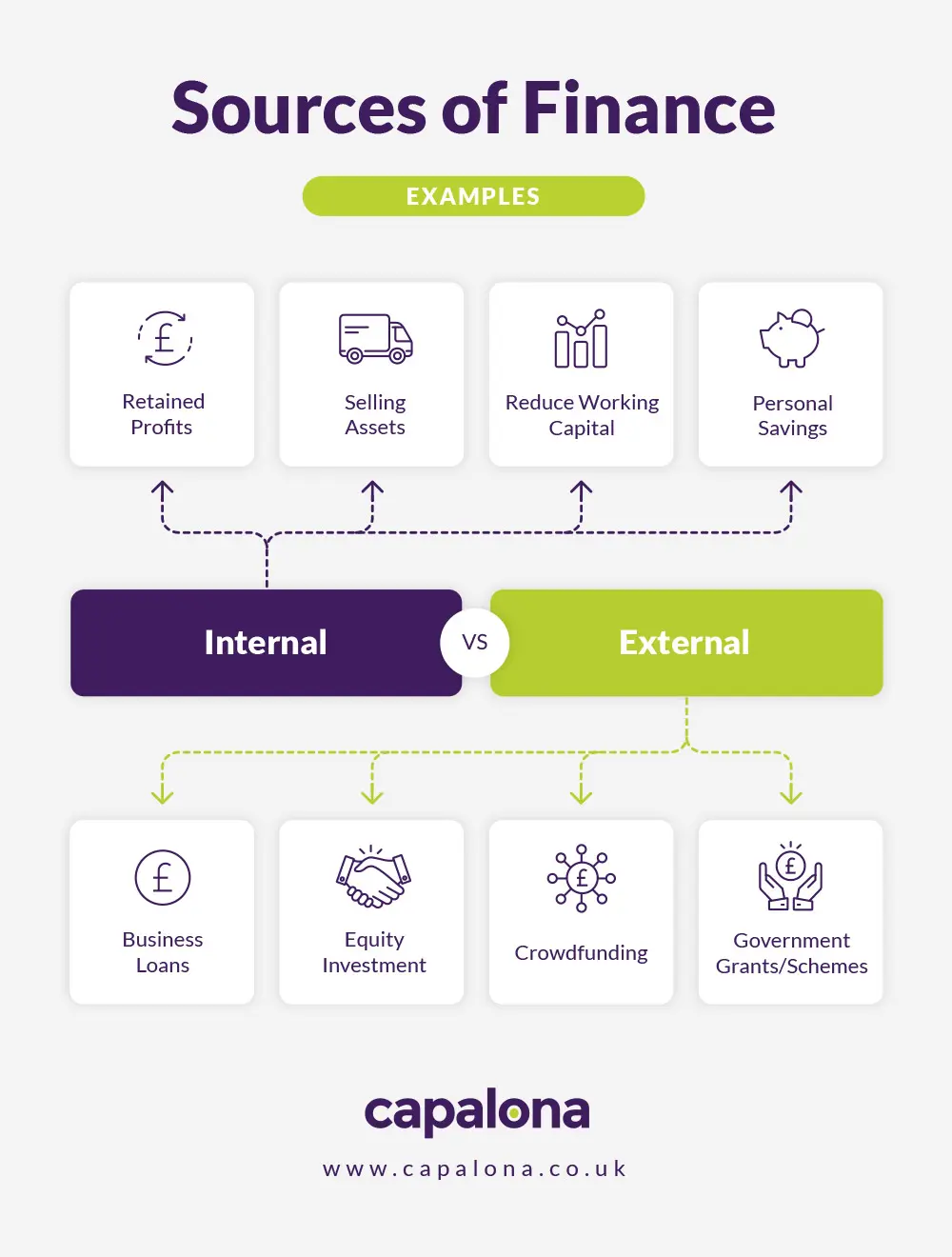

Internal sources of finance are funds generated within the business itself. These are typically the first options companies consider due to their accessibility and lower risk. Internal sources of finance include:

1. Retained Profits

These are profits not distributed as dividends to shareholders. So they are free to be reinvested into your business. This doesn’t cost you any more (i.e. fees) and makes reinvesting in your business as simple and quick as possible.

2. Selling assets

If you have assets you don’t use, such as property, vehicles, or a piece of equipment, you can sell them to raise cash for reinvestment. This type of internal finance can take a little longer than retained profits, as you have to find a buyer first.

3. Reduce your working capital

By making business operations more efficient, you can free up funds to use elsewhere in the business. For example, you could switch to a more cost-effective supplier or digitise processes to cut costs on paper.

4. Personal savings

You can put your own money into your company to purchase new software, bulk buy inventory, hire new staff, or do whatever you want to do. If you have personal savings, using them can be quicker and cheaper than applying for business finance.

You could also consider borrowing money from friends and family.

Advantages of internal finance

- No interest payments. By reinvesting money you already have in the business, you don't have to pay interest.

- Keep 100% control of your business. With no external financial help, you don't have to part with equity. Instead, you remain in full control of all business decisions.

- Finance can be quicker to access. If you're putting personal savings into the business or using retained profits, for example, the money is there to use straight away. There’s no application process, so no waiting around.

Disadvantages of internal finance

- Available funds limit you. Unlike with a business loan, you're limited by the amount you have in your internal funds.

- Slower business growth. Because funds are limited, you can't invest heavily in your business, which means you can't take too many calculated risks.

- Fewer cash reserves. If you deplete all your cash reserves for reinvestment, you might find yourself in a tricky situation — maintaining a healthy cash flow becomes more challenging, for example, and you can’t fund unexpected expenses with ease.

What are external sources of finance?

As you might expect, external finance is when you seek funds from outside the business. This means you can explore various sources to find the funding you need to invest heavily in your business. External sources come with a few strings attached, ranging anywhere from paying interest fees to giving away equity in your business.

So, what’s classed as external sources of finance?

1. Business loans

If you’re applying for a business loan, this is external funding called debt financing. These funds can be quick to obtain (sometimes in your account within 48 hours), and you can repay the loan, plus interest, over a reasonable period of time. Some secured bank loans can be repaid over more than a 10-year period.

Explore all our business funding solutions.

2. Equity investment

Think Dragon’s Den — angel investors or venture capitalists. Equity finance can mean you access more funds than you realised was possible, and not only can you secure high amounts of capital, but you also get to tap into the investor’s business experience. This option means parting with some business equity, so you no longer make all the business decisions.

3. Crowdfunding

This is where you seek small amounts of investment from many smaller investors. Platforms like Kickstarter can help you launch your product or service and, at the same time, give you a real feel for audience sentiment and market demand.

Raise funds and give investors something in return for their support. For example, if you’re opening a new restaurant, you might give away a three-course meal to each small investor to say thank you when you eventually launch your business.

Find out more about Crowdfunding here.

4. Government grants and schemes

You can access a wide variety of grants from the UK government, and although there are plenty to choose from, they’re pretty competitive. The process can be long and drawn out, which isn’t the best option if you want to start growing your business imminently.

Advantages of external finance

- Unlocks large investment opportunities. If you want to rehaul your product packaging or tap into new markets without depleting your cash on reserves, external finance can help you fund your ideas.

- Quicker business growth. If you want to reach ambitious business goals quickly, external finance can help you do just that. Applying for business finance means you're not waiting around to make big business decisions.

- Take advantage of investor experience. If you choose to work with an angel investor, you can use their expansive industry experience to help you grow and gain a competitive advantage.

- Business finance is flexible and accessible. The online lending platform marketplace is competitive, which means the borrower has many financing options available to suit their specific business needs.

Disadvantages of external financing

- It can be expensive. When applying for business finance, there are usually some fees to pay. The most obvious one is high interest rates. But lenders can also charge administration fees, early repayment fees, and more. Always read the terms and conditions before applying.

- Might have to give away equity. If you choose to seek funding from an investor, you might need to give away equity in your business. This means they'll have a say in how you operate your business and the direction you take it in, which can lead to testing relationships.

- Can risk losing an asset. If you apply for secured finance, you must put up an asset as collateral. These high-value assets can be either tangible, like vehicles and property or intangible assets, such as software or copyrights. If you fail to make timely repayments, these assets can be seized.

- Could be personally liable for business debts. If the lender asks you to sign a personal guarantee, this helps them lessen the risk to their investment. Because if your business is unable to make payments, the lender will expect you to pay from your personal finances.

Internal or external finance: which option is right for my business?

Ultimately, your decision will depend on why you want the finance in the first place. For example, if you need access to larger amounts of money, you may need to look outside your organisation for funding support.

Other factors that might influence your decision include how quickly you need the funding, i.e. can you wait 48 hours for an unsecured loan, or do you need it immediately? In these circumstances, using retained business profits, or dipping into personal savings might be the best option.

You should also consider the cost of external finance. Can you comfortably afford repayments with interest? You don't want to find yourself trapped in a cycle of debt, but if you can afford the repayments, a loan can give you the opportunity you need to grow quickly.

Taking on debt can be a high risk, so you should always consider if the risks are worth taking before applying.

Find and compare eligible loans with our free business loan comparison tool.