Full expensing has been introduced to encourage UK businesses to invest more in modern plant, tools, and technology. So if you want to upgrade your equipment but don’t know how full expensing can help or whether you qualify, read on to learn more.

What is full expensing?

A replacement for the super-deduction, full expensing is a new capital allowances offer that enables businesses to write off the full cost of their investments in one go rather than spread it over multiple tax years. This scheme is currently running from April 2023 to the end of March 2026, so you have three years to take advantage of it.

How does full expensing work?

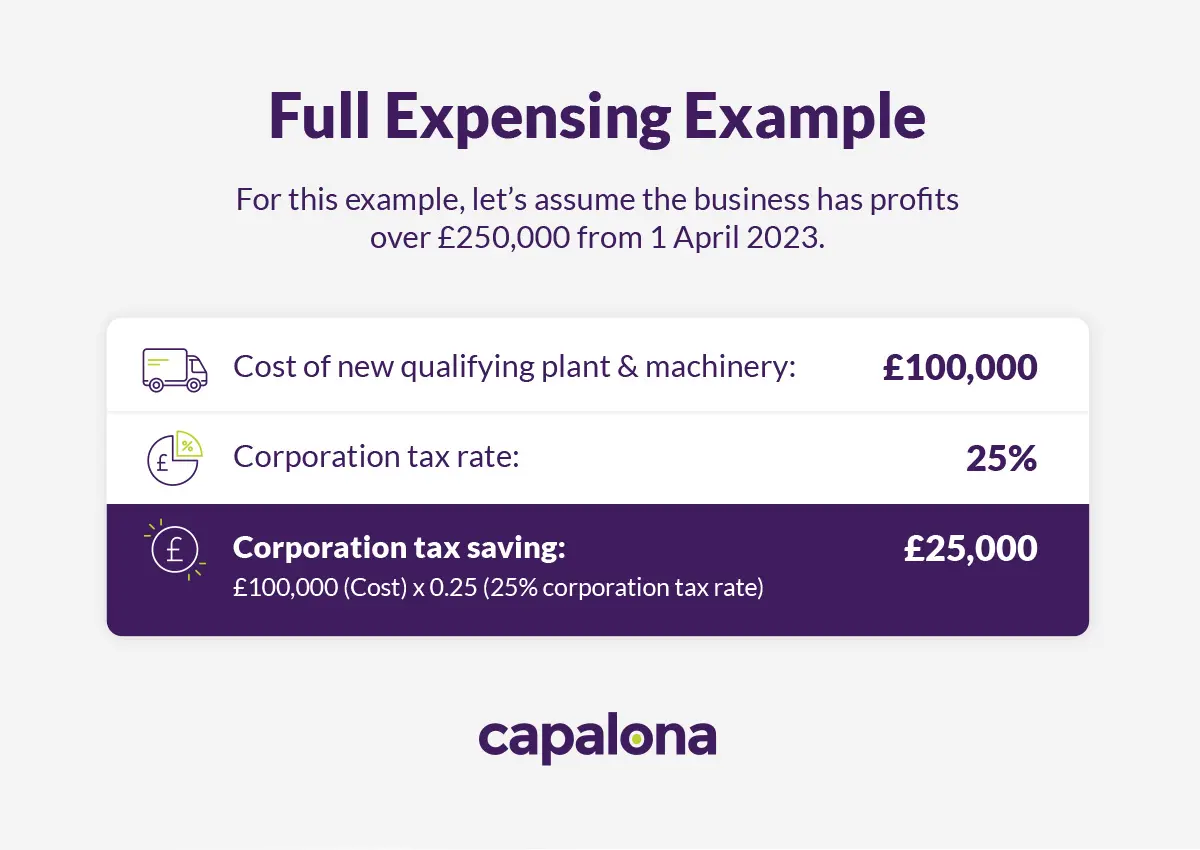

With full expensing, for every pound your company investments, your taxes will be cut by up to 25p. So if you’ve invested £100,000 in upgrading your technology or buying new plant or tools, you can claim back 100% of the cost by writing it off against tax on your profits. Assuming corporation tax at 25%, you’d save £25,000 in taxes.

It’s worth noting that full expensing is less generous than super-deduction, but your business can financially benefit from it much quicker. As it’s only in place for the next three years (so far, it could be extended), it makes sense to take advantage of the new capital allowances offer before time runs out.

So if you’re planning to invest in the future, you might want to make these plans a reality sooner rather than later.

What are capital allowances?

Capital allowances are a way to reduce your tax bill by deducting some or all of the cost of an item from your profits before you pay it.

There are a few types of capital allowances in the UK:

- The Annual Investment Allowance (AIA), allows businesses to claim 100% of the cost of plant and machinery up to £1m in the year it’s incurred.

- Writing Down Allowances (WDAs) which spread the tax deductions over time at 18% and 6% a year for main rate and special rate expenditure, respectively.

- First-Year Allowances (FYAs) allow a company to claim a percentage of the cost of plant and machinery investments in the year it is incurred.

- Structures and Buildings Allowances (SBAs) allow businesses to deduct 3% each year over 33 1/3 years for qualifying expenditures on non-residential structures and buildings.

Why is full expensing being introduced?

Full Expensing is being built on the back of the super-deduction to encourage businesses further to make investments in their businesses. This is all part of the wider plan to bring investment forward — helping position the UK as a world leader in capital allowances.

What type of equipment qualifies for full expensing?

When it comes to claiming capital allowances, most tangible capital assets, excluding land, structures and buildings, are considered qualifying plant and machinery.

Here are some examples of eligible assets for full expensing:

- Warehousing equipment, including forklift trucks

- Office equipment, including computers, desks and chairs

- Vans, lorries and other vehicles (but not cars)

- Tools, including ladders and drills

- Some non-residential property fixtures, including kitchens and bathroom fittings

What happens if my company sells an eligible asset?

If you’ve claimed full expensing on an asset you’re disposing of, you’ll be required to bring an immediate balancing charge equal to 100% of the disposal value. So if you sell an asset for £5,000, you need to increase your taxable profits by £5,000 (if you claimed full expensing for that particular asset).

If you’ve only claimed the 50% first-year allowance on the asset you’re disposing of, you’ll increase your taxable profits by 50%. So if you sell the asset for £5,000, you’ll increase your taxable profits by £2,500, with the outstanding £2,500 being deducted from the pool.

How does full expensing differ from super-deduction?

Super-deduction was a scheme introduced to help businesses recover from the pandemic. The super-deduction lets you deduct up to 130% of the cost from your profits before tax, with a 50% special rate first-year allowance letting you deduct 50% of the cost from your profits before tax.

Although full expensing works in the same way, it’s limited to just 100% of the cost of the purchased assets. Full expensing is replacing super-deduction.

Am I eligible for full expensing if I’m a sole trader?

No. If you’re a sole trader or a partnership or a limited liability partnership (LLP), you cannot take advantage of full expensing. However, if you’re a limited company and you spend money on qualifying equipment, you are eligible to utilise full expensing. You must be an incorporated company that pays corporation tax to take advantage of full expensing.

How Capalona can help

To buy these assets in the first place, you’ll need access to working capital, which is where we can help you.

At Capalona, we can help you access the funding you need to grow your business now, so you can take advantage of temporary full expensing before the scheme comes to an end in March 2026.

We’ve helped thousands of SMEs secure the funding they need to purchase assets.

Our lenders offer fast and flexible funding, including equipment financing, asset finance and asset refinancing. Let us help you find and compare lenders for free. Find and compare SME loans.