With the introduction of open banking, banks no longer monopolise customers’ financial information. Instead, trusted third-party providers can use this information to improve the customer experience, changing how we bank and manage our finances for the better. Open banking means more freedom, more financial transparency, and more control for the consumer.

What is open banking?

Open banking is a system where existing banks open up their customer transactions to third-party providers. That means you can authorise comparison sites, like Capalona, to access bank transactions. Our system analyses the transactions, and the customer receives loan offers more suitable for their current financial situation.

Other scenarios that use open banking in business include:

- Identity verification

- Payroll services

- Opening new business accounts

- Assessing credit risk (whether you have good credit or bad credit)

Initially, only nine of the largest UK banks participated in open banking, including Barclays, NatWest and Santander. Now, there are over 50!

Is open banking safe?

The system open banking is built on is secure and robust, with plenty of safety measures, including banking provider GDPR compliance and other data protection rules. Open banking only takes place between FCA-agent fintech companies and banks. All data is accessed through secure open banking APIs (application programming interfaces), which means a secure connection is formed between the customer’s bank account and the fintech firm.

The FCA has rolled out this system to make it easier for customers and give them control over who accesses their banking data. Essentially, banking is evolving. And although it might seem daunting to allow third-party apps access to your banking information, it’s completely safe.

Do I have to consent to open banking?

Yes. Third-party applications must ask for your permission before accessing your banking transactions. So it’s completely up to you whether you want to participate. Before consenting, check that the banking provider or fintech platform is registered with the FCA (Financial Conduct Authority). It’s important to note that you can withdraw your consent at any time.

Advantages of open banking

A more competitive marketplace

It’s not just banks that have access to banking data; fintech platforms are now able to compete in this marketplace. With fintech platforms remaining mainly cloud-based, overheads are low, which means savings are passed onto the consumer. Business finance has never been more affordable, flexible and accessible than it is right now.

Open banking forces banks to modernise

With new players constantly entering the finance market, banks are pressured to modernise their services and customer experiences. With many high street heavyweights fine-tuning their digital offering, taking advantage of biometric authentication in their banking apps and introducing intuitive features, the customer benefits from all these improvements.

Financial institutions can offer personalised services

If you receive finance services that are more relevant to your needs, you’re more likely to find those services more engaging. There are a lot of businesses out there vying for consumer attention, so if you can lure customers with customised financial services that meet their specific needs, you’re going to be the stand-out brand.

The power sits with the consumer

With hundreds of players entering the UK market for the first time, the customer has a lot of choices. They’re no longer bound to one bank. Instead, they can compare lenders on the market in seconds.

The drawbacks of open banking

Customers are still treading carefully

Although open banking adoption has increased since its inception in 2015, with eight million active open banking users as of 2023, many still have questions. Changing the way you’ve managed your finances for many years is daunting, but as open banking becomes more widely used, the acceptance rate will no doubt continue to rise.

Not everyone wants a digital-only experience

Research shared by Forbes found that 86% of consumers actually prefer talking to human customer service staff over chatbots. So, for all the digital-first products open banking is generating, it’s important brands don’t forget the importance of available human contact for resolving certain issues.

How we use open banking at Capalona

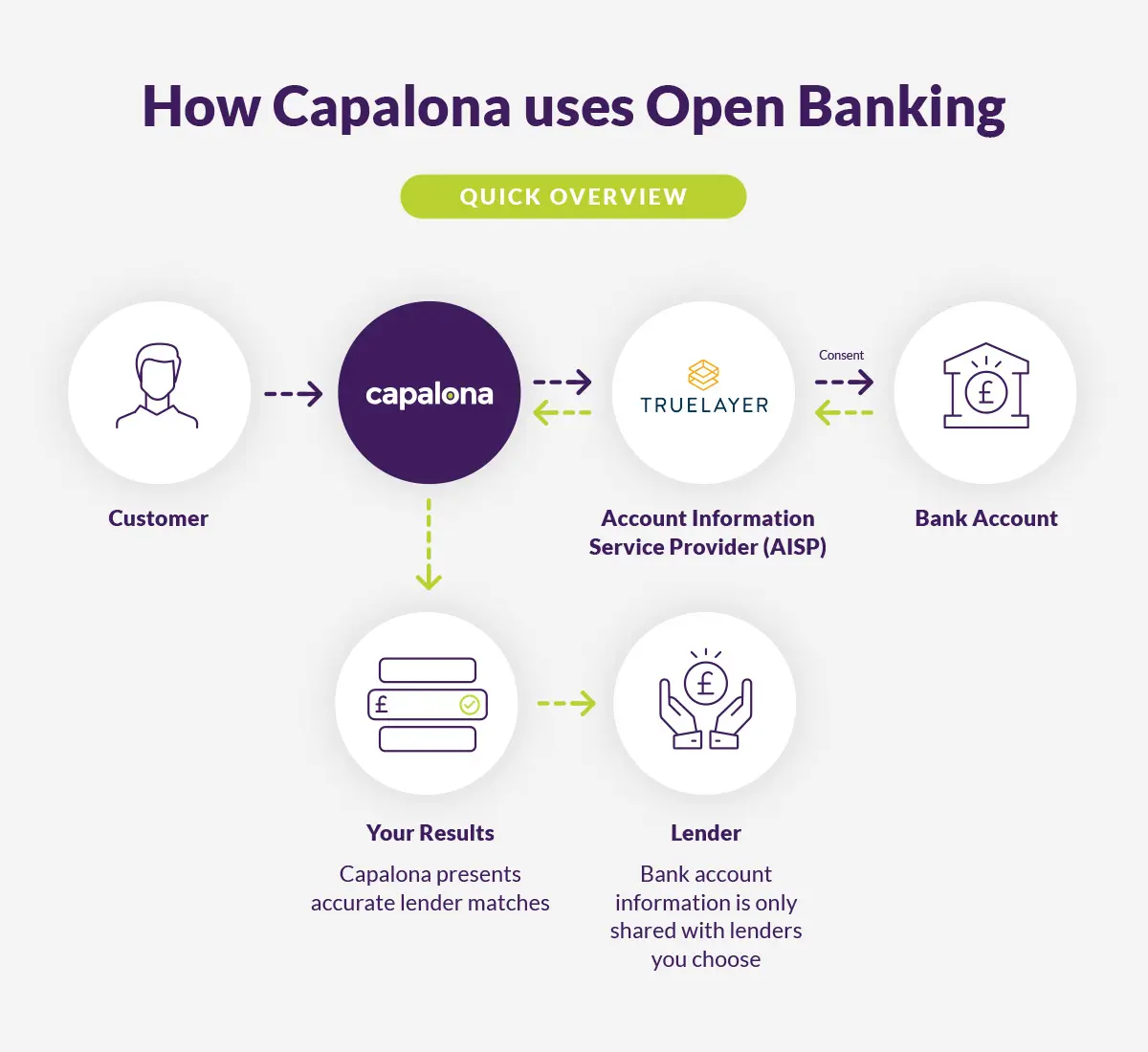

So, when we’re talking about open banking, what kind of thing are we talking about? Here’s how we use open banking at Capalona:

We’re an authorised FCA agent of TrueLayer, which means we can use open banking to match customers’ financial needs with the perfect business loan. By aggregating the customer’s account information, bank transactions and identity data, our systems paint a clear picture of your financial situation, giving us the opportunity to offer hyper-personalised business finance options. Not only is the process self-serve, but our system just takes a few minutes to generate all eligible loan offers.

Browse at your leisure, expand each loan offer to read more, and, if you find one you like the look of, click through to proceed with your application.

Use our free loan comparison tool to find and compare the best business loans on the market. Compare interest rates, total repayable and more in just a few clicks. Get a quote today.