If you’re wondering what a VAT number is and who needs one, you’ve come to the right place.

In this blog, we’ll explain what a VAT number is before showing you how to identify VAT-registered companies and locate their VAT numbers.

What is a VAT number?

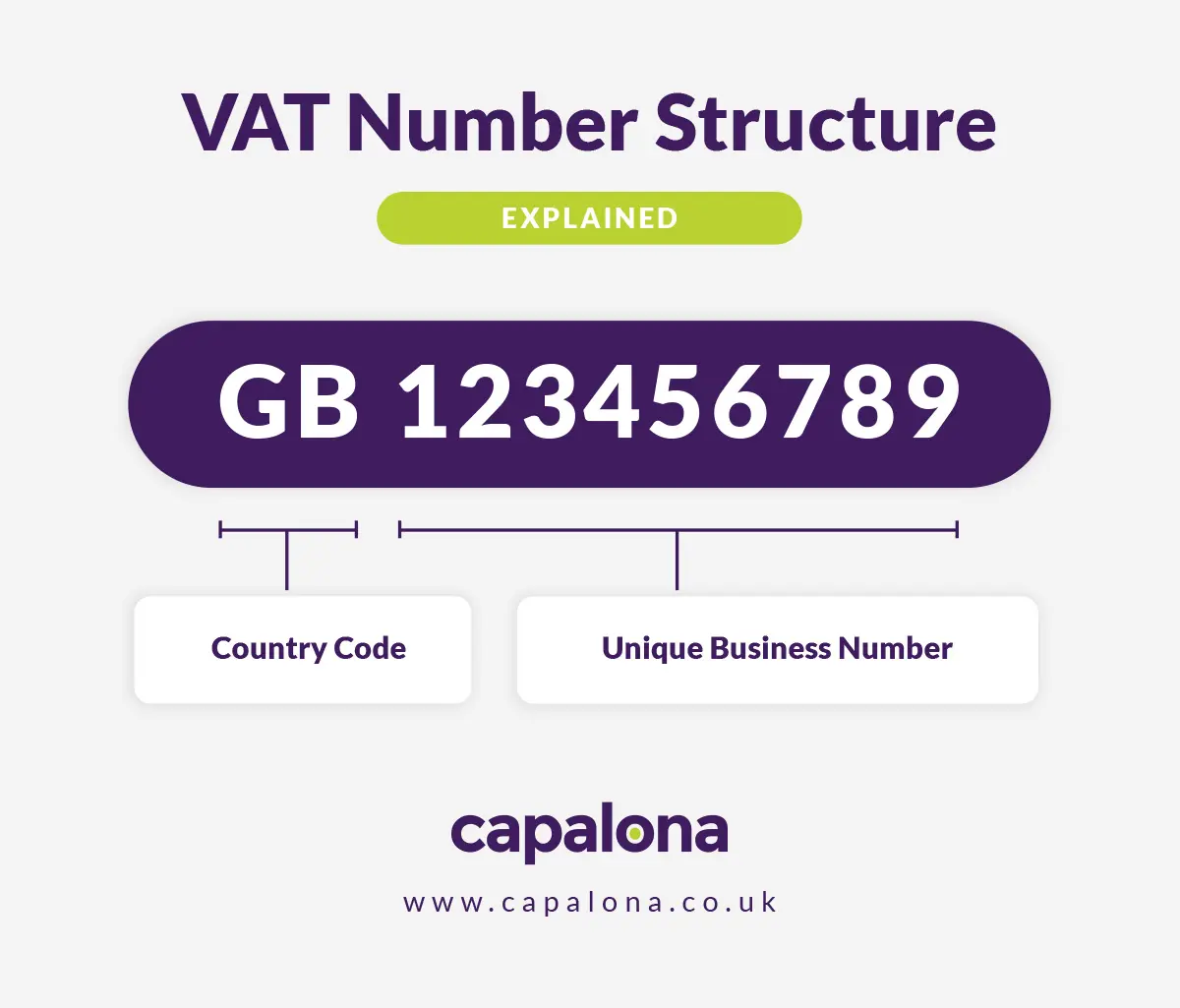

In England, Wales, and Scotland, a VAT number or value-added tax number is a unique 11-digit code that VAT-registered companies receive from HMRC. The code consists of nine numbers, with the prefix ‘GB’—for example, GB 123 4567 89.

These codes guarantee proper VAT collection, reporting, and general compliance for VAT-related tax purposes.

Who needs a VAT number?

Anyone registered for VAT will receive a VAT number from HMRC. If a company’s taxable turnover exceeds £90,000 within a 12-month period, they must register for VAT, which means they’ll also receive a number. You’ll also receive a VAT ID if you purchase more than £90,000 of goods from a VAT-registered EU supplier.

If you voluntarily register for VAT even if you don’t meet the income threshold, i.e. for credibility reasons, you’ll also receive a VAT number.

How to check if a company is VAT-registered

You can check if a company is VAT-registered by looking at their website. They must legally display their VAT number on their website, in business correspondence, and invoices. If you ask for their VAT identification number, they’re legally obliged to do so.

So, if a company doesn’t have a VAT number on its website, it’s safe to assume it’s not VAT-registered.

To check a VAT number's authenticity, you can use HMRC’s VAT registration number checker and enter the 11-digit code to reveal whether the VAT number is valid. If you don’t have the number to check, you can always call HMRC directly to confirm.

FAQs

Where should I display my VAT number?

Your number must be displayed on your company website, invoices and receipts issued to customers and clients, and VAT returns when sent to HMRC. Failure to do this may lead to several issues, including financial penalties from HMRC and problems completing transitions with customers who may require your VAT identification number to complete transactions.

Is a VAT number the same as a company number?

A VAT number is not the same as a company number. A company registration number (CRN) is a unique eight-digit code assigned to all incorporated businesses when they first register with Companies House. It’s used for legal identification and governmental administrative purposes.

A VAT registration number is 11 digits and is only given to companies registered for value-added tax and used for VAT-related purposes.

How long does it take to get a VAT number?

The process of VAT registration can take between 10 and 14 days, so you should allow for this time frame. Even though you may not receive your number immediately, you should notify your customers of your VAT status either from your effective date of VAT registration (if you exceeded the income threshold in the last 12 months) or immediately after you first realise you’re going to exceed the threshold.

What is a VAT ID?

A VAT ID is simply another name for a VAT number. It can also be known as a VAT registration number or a VAT identification number.

What if I can’t afford my VAT bill?

If you’re worried about paying your VAT bill on time, you can apply for a VAT loan, ensuring you’ll never be out of pocket or miss a VAT bill deadline again. Instead, after calculating your VAT, you can pay for your VAT in monthly instalments; spreading the cost like this keeps much-needed funds in your business.

At Capalona, we can help you find and compare VAT loans using our free business loan comparison tool. The tool is self-serve, and there’s no obligation to accept any loan offer you’re presented with. Find and compare VAT loans.