As a business owner, any capital invested in your business should deliver value. That’s why you need to understand the capital employed. Are you making efficient use of your invested capital? Or are you missing opportunities to become more profitable and efficient?

This blog explores the definition of capital employed, why you should care about it and how to calculate it to set you up for long-term business success.

What is capital employed?

Capital employed (also known as funds employed) refers to the total amount of capital invested in a business for the purpose of generating profit. This capital might be used to fund assets or business operations and includes both debt and equity capital.

This financial metric can help companies understand how efficient they are at generating a profit from available capital. Basically, how well are you using your resources and could they be used to better generate revenue?

The differences between debt and equity capital

Debt capital is a debt you take on and repay in fixed monthly instalments, like applying for a business loan from a creditor. Equity capital is capital invested by shareholders like investors or directors, so they require equity in your company in exchange for the capital invested.

How to calculate capital employed

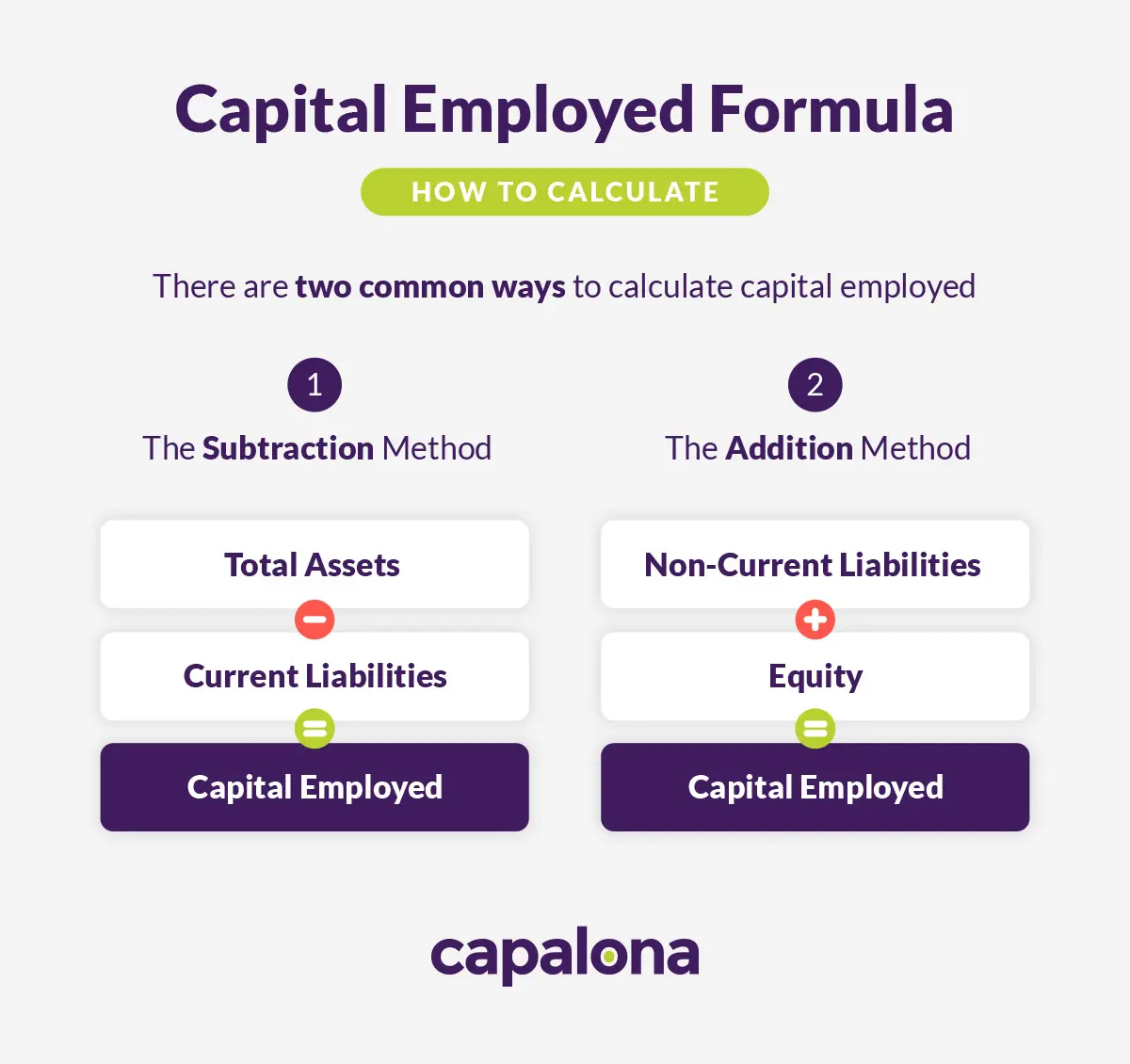

Managing business finances can be overwhelming as a small business owner, so we’re sharing two formulas to help you calculate your capital employed:

Capital employed = total assets - current liabilities

Or

Capital employed = non-current liabilities + equity

Always use book values from your balance sheet when calculating capital employed instead of market values.

Regardless of which formula you use to calculate your capital employed, make sure you consistently use the same formula to calculate it going forward.

An example of capital employed

Let’s say you have current assets of £50,000, non-current assets of £100,000, current liabilities of £40,000 and non-current liabilities of £80,000.

Using the following formula: Capital employed = total assets (£50,000 + £100,000) - current liabilities (£40,000). The total capital employed is £110,000.

How to calculate capital employed from a balance sheet

Using your balance sheet is the easiest way to work out your capital employed because the figures are already there, so the process is more efficient, representing a more accurate picture of your assets and liabilities.

- Find the net value of your fixed assets. These assets include property, plant and equipment (PP&E). Report these with their depreciated value.

- Add capital investments (e.g. from financial institutions, other funding, personal investment)

- Add your current assets, including cash in hand, stock and other current assets, excluding long-term assets.

- Take away your current liabilities. Minus all short-term liabilities, including accounts payable and short-term loans — basically, anything you will have paid off within the year.

How to Calculate Return on Capital Employed

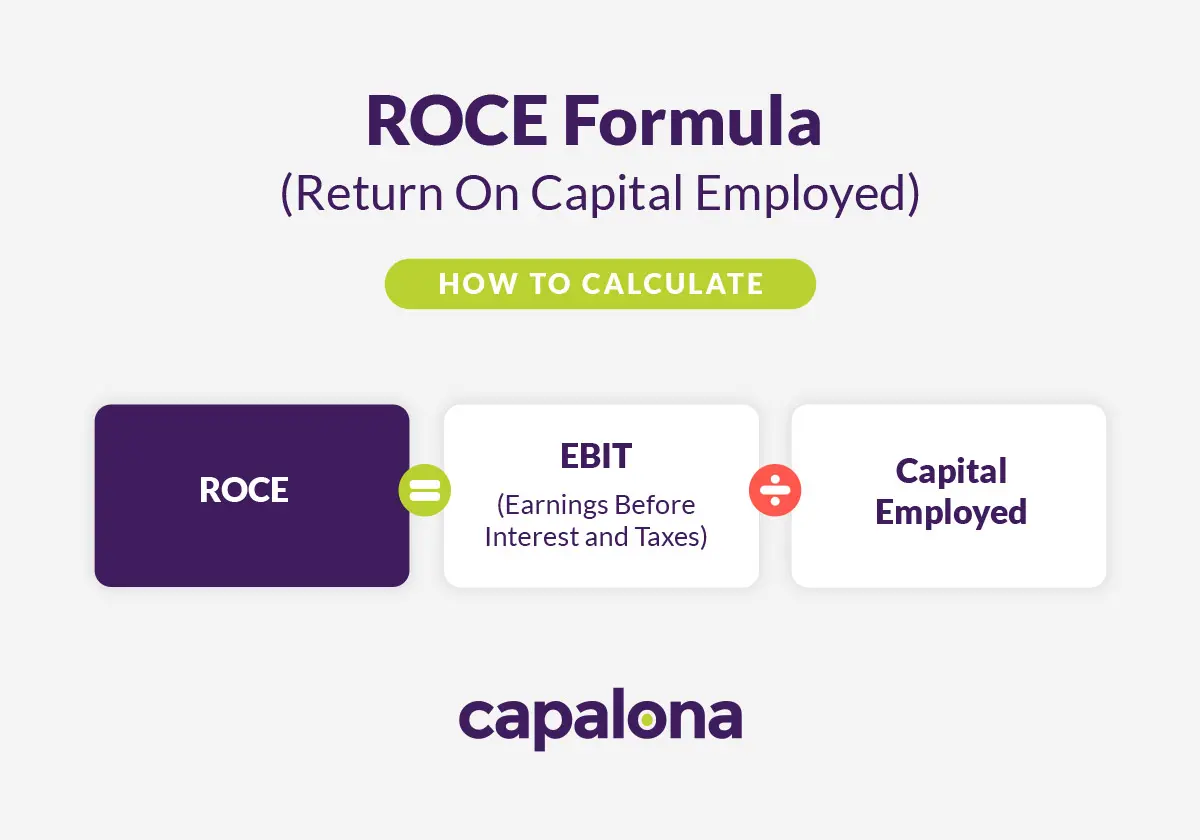

Although capital employed is a useful financial metric, it’s most useful when used alongside ROCE, which stands for return on capital employed. ROCE gives you a more comprehensive picture of your profitability as a company, enabling you to benchmark yourself accurately against others in your industry.

It’s also a metric that investors highly value, so if you’re looking to secure investment in the future, it’s worth taking the time to understand how to calculate it.

To calculate ROCE, you can use the following formula:

ROCE = EBIT / Capital Employed

If you’re not sure how to calculate your EBIT (earnings before interest and tax), use this formula:

EBIT = revenue - operating expenses

So, let’s say your EBIT is £22,000. Using the total capital employed from our example above, £110,000, we can apply the ROCE formula:

ROCE = £22,000 / £110,000 = 0.2 or 20%

What’s a good return on capital employed (ROCE)?

Generally, the higher the ROCE, the better. Around 15% to 25% ROCE is considered good, but the best way to determine if you’re lagging behind in your industry is to look at the companies you compete with. Some industries have a lower ROCE than others, such as car manufacturing or utilities, so understanding this can help determine whether your ROCE is above average.

Limitations to capital employed

- The book value of assets is not impacted by inflation. Where company revenue would increase in light of inflation, your assets would not, and this can distort results, making them unreliable.

- It’s hard to accurately predict long-term growth. If your profit waivers in the short-term, this can affect the ROCE results, which means it’s not ideal for predicting future growth.

- If seasonality isn’t accounted for, your ROCE results may be skewed and, again, unreliable.

Always benchmark against others in your industry to better understand your financial position. And don’t rely solely on this financial metric. Consider other things like cash flow, trend analysis, profit margins, and debt ratios, amongst others, to understand growth potential.

If you want to increase your working capital but don’t want to part with equity. Debt financing could be the funding solution you’re looking for. Find and compare UK lenders in seconds with a free loan comparison tool. View eligible loans today.