If you’ve experienced cash flow problems, you’re not alone. According to a survey by QuickBooks, 57% of UK small business owners have faced these issues, too.

Cash flow is the lifeblood of any small business. Without it, you can’t plan or forecast, which means you’re probably worried about whether you can pay your bills in the coming months. You start asking yourself questions like can I afford to keep my staff? Can I purchase more stock? Can I market my business?

But the good news is that by calculating net cash flow, you’ll get a clearer picture of your business’s financial health. Knowledge is power — so knowing whether you have positive or negative cash flow can put you in a much better position to improve your cash flow.

Keep reading to learn what net cash flow is, how to calculate it, and how to improve a negative one.

What is net cash flow?

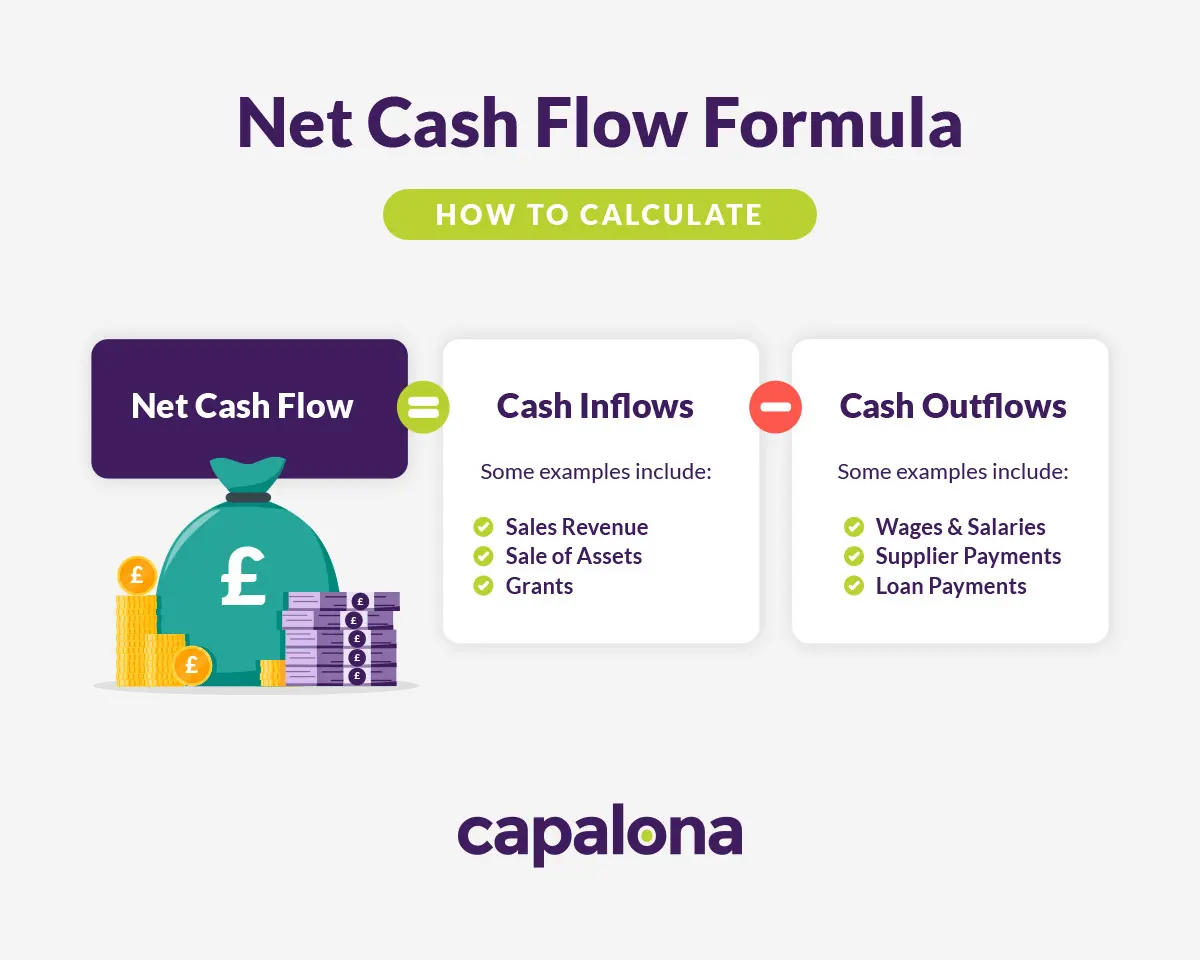

It’s when you subtract your total cash inflows from your total cash outflows, and it can be calculated monthly, quarterly or annually — whatever your company reporting cycle is. You don’t want your outflows to be higher than your inflows, giving you a negative cash flow.

You can separate net cash flow into three elements:

- Operating activities — cash inflows and outflows of sales revenue, invoice payments from customers, cash paid for utilities and rent.

- Investing activities — cash inflows and outflows of any assets your company invests in, i.e. property or equipment.

- Financing activities — cash inflows and outflows from debt repayments or paying dividends.

After calculating your cash flow, the remaining figure gives insight into whether you can afford to invest in new marketing strategies, purchase stock, or something else in the short term. Or whether you need to improve your net cash flow.

The net cash flow formula

The annual cash flow formula is:

Net cash flow = cash inflows - cash outflows

Here’s a real-life example to help you understand this formula in greater detail.

You run a veterinary practice, and your net cash flow from operating activities is £50,000; you lost money from property assets, so your investing activities are -£10,000, and your financial activities are £100,000.

Using the formula above:

£50,000 + £100,000 - £10,000 = £140,000

The net cash flow for your veterinary practice is positive, which means your business has short-term viability. You can purchase new x-ray machines or upgrade tech to improve your customer and patient experience, hire new vet technicians or pay off debts.

If you calculate your net cash flow and it’s negative, it’s time to implement some cash flow management strategies to help turn that negative into a positive.

Limitations of net cash flow

Calculating your net cash flow doesn’t give you a full picture of your business’s financial health. This calculation doesn’t take costs and revenue into account, so you shouldn’t use it as a substitution for an income statement.

You could have negative cash flow for many different reasons such as a period paying of debt or unexpected expenses. That’s why, on its own, this formula doesn’t paint a full picture.

How to improve negative net cash flow

Just because your net cash flow is negative doesn’t mean you can’t turn it around. How can you improve it?

Firstly, you should take the time to understand where your cash is coming and where it’s going. Pinpoint areas you can cut costs down to minimise outgoings — look for ways to reduce operating expenses e.g. negotiate supplier contracts and streamline your operations where you can. You can also consider credit checking your customers before working with them to ensure they’re reliable and creditworthy.

Another way to improve net cash flow is to apply for invoice financing or other cash flow loans. Invoice financing helps you unlock up to 95% of the cash tied up in your unpaid invoices. So instead of waiting 30 days for your customer to pay your invoice, you get the cash immediately, keeping your cash flow healthy and more predictable. Using buy now pay later providers can also help your payments come in sooner.

Learn more about invoice finance or get a cash flow business loan quote today.