Invoicing your customers is an exciting part of managing your own business. It signifies the end of a project or the sale of a product, and payment for your hard work is within touching distance.

An invoice should look professional and contain all the information the client needs to pay correctly and promptly. If you’ve never sent an invoice before, or you want to check your invoice has all the correct components, this blog will take you through the information to include and why it's important.

What is an invoice?

An invoice is a payment request and is sent out after the work is completed or sent out to receive partial payment; perhaps you’re halfway through a project and have reached the first milestone, unlike a receipt, which is generated for customers after payment or a purchase order, which is a confirmation of intent to purchase.

Invoicing customers helps you keep track of payments accurately — this comes in handy when you or your accountant fills in your tax return.

5 steps to writing an invoice

So, how do you write an invoice? Here’s a step-by-step guide to invoice writing:

1. Choose a simple and professional invoice template

You don’t need to get too creative when designing your invoice; clients will expect a pretty standard invoice format so they can easily identify the information important to them to make payment.

You don’t have to write an invoice template. Instead, you can find many template ideas online or use invoicing software to create, send and keep track of your invoices and income in the same place.

2. Add both party’s company details

Include basic company information such as your registered business name, address, phone number, and company number (if you’re a limited company).

You should also include the buyer’s details, including their company name, address, and the person you’re invoicing so it gets sent to the correct person.

3. Include details of the product or service provided

Always clearly state the service details and price you’re invoicing for because the person receiving the invoice might not have had any part to play in your relationship this far.

For example, you design a website for a client and invoice for the website design, but the invoice gets sent straight to the accounting department, not your initial contact. Simply invoicing for the full amount with no description can mean payment delays and confusion on the customer’s end.

Always stipulate exactly what you’re invoicing for, leaving no room for misinterpretation.

4. Include an issued and due by date

These dates help you clearly track when you’ve sent invoices when to expect a payment, and see when they’re overdue and require a gentle reminder.

These dates should be prominently displayed, usually near your company details. It can help to make the due date in a larger font and in a different colour so it’s more obvious to the recipient.

5. Include an invoice number and payment terms

Although payment terms might have already been pre-agreed, it’s important to remind customers of them. The most common payment term for business payments is 30 days. However some customers will have longer payment terms, from 60 days up to 120 days.

Knowing specific customer payment terms can help you better plan your business cash flow, so always share your payment terms with them to check you both agree on when payment will be made.

You should also include an invoice number on each invoice you create and send out. This is a unique number for your records to keep track of payment and ensure no invoice duplications.

6. Include your bank details

You’ll need to include your business bank account details (or personal account details if you don’t have a business account) to get paid on time. Basic details include the name on the account, which might be your company name or your personal name, sort code and account number.

If the customer is paying you from another country, they might need your bank’s SWIFT code and international bank account number (IBAN) to ensure payment goes to the correct bank account. Don't worry if you don’t know them; they can be found on your bank statement.

Your customers don’t have to pay you through bank transfer, though. You might want to offer different payment options, including PayPal. Choose whichever option best suits your business.

7. Make sure your subject line is clear

Whether you’re sending your invoice via email as an attachment or through invoicing software, always make sure to include a clear subject line. It’s good practice to include the invoice number, company name, and due date. This ensures that the person managing accounts payable can instantly recognise your email as an invoice request for payment.

Be sure to keep this format consistent for each invoice so clients can always identify your email.

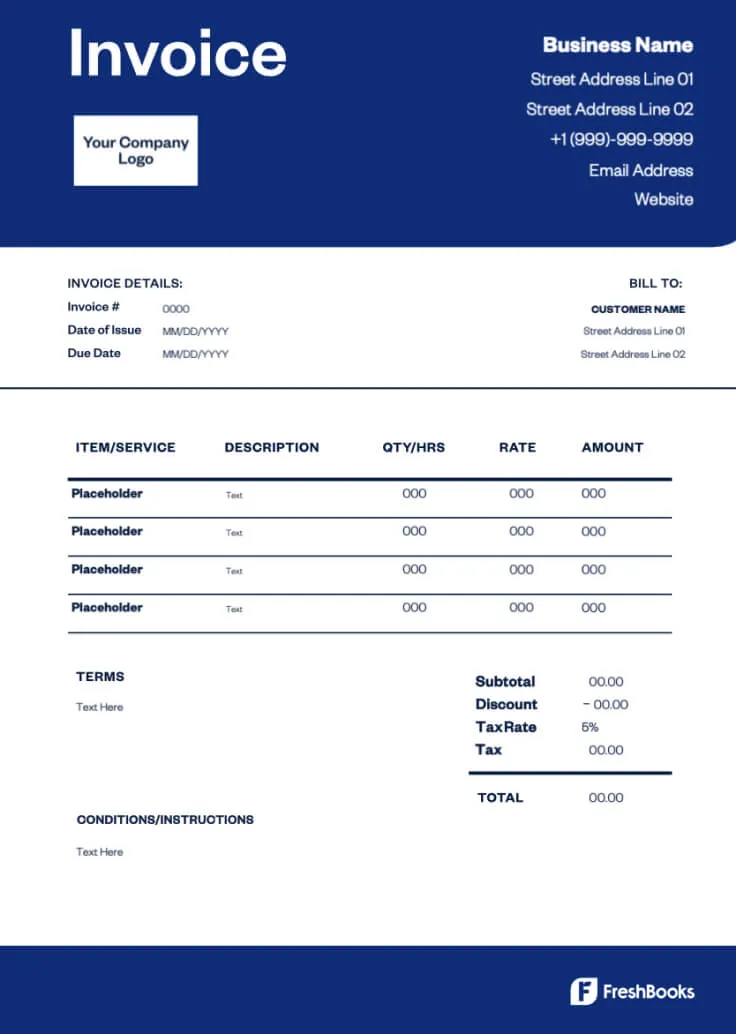

An example business invoice

Here’s an example of a free invoice template from FreshBooks:

Source: Invoice template from FreshBooks.

Invoice checklist

When you’re next creating an invoice, cross reference with the invoice checklist below to ensure you have all the right components.

- Business contact details (address, company number and name, VAT number if applicable)

- Business logo and colours

- Client’s name and company address

- Invoice number

- Invoice issue date and due date

- Details of services or products provided

- Subtotal and total, including VAT if applicable

- Payment terms

- Payment information (sort code, bank account number, SWIFT code and IBAN)

- Write a clear subject line

Should I consider invoicing software?

Invoicing software can help your business appear more professional while reducing administration for you. For example, invoicing software can send out automatic late payment reminders, and income is automatically displayed when money is paid into your business bank account. So there’s no need to calculate your income manually.

Invoicing software can ensure your bookkeeping is accurate for your annual HMRC tax return, and many grant accountant access.

If you’re self-employed and not registered for VAT, pricing can start from as little as £2.50 per month with QuickBooks.

Should I consider invoicing software?

As a small business owner, you have to wear many hats, which means it’s usually down to you to ensure you invoice customers correctly to ensure prompt payment. You can make the process efficient and professional by creating an invoice containing all the information customers need to pay.

If you’re struggling with late invoice payments, check out our guide on handling unpaid invoices.