Asset Finance

Asset Finance enables your business to refinance your existing assets or rent equipment or vehicles with the option to purchase. This allows you to spread the cost of the repayment over time avoiding the need to buy the item outright.

- Compare a wide range of lenders and rates

- Check your eligibility in minutes

- Find out how much you could borrow

It's fast, free and won't affect your credit score

- What is asset finance?

- How does asset finance work?

- Why use asset finance?

- What type of assets can be financed?

- How long is asset finance used for?

- How do you finance a business asset?

- What are the different types of asset-based finance?

- What are the benefits of asset finance?

- Is asset finance the same as invoice finance?

- Which industries benefit from asset finance solutions?

- Does my business qualify for asset finance?

- Choose Capalona to arrange your business’s asset funding

What is asset finance?

Asset finance is a flexible type of lending agreement that helps businesses access new assets without having to buy them outright. It can also be used to release money from the value in existing business assets. Asset finance is a popular choice with UK SME businesses who need to purchase high-value equipment to help them grow.

Asset finance can unlock cash tied up in your existing business assets or enables you to access new equipment such as machinery or vehicles through a hire agreement with the option of buying the asset at the end of the contract.

Common types of business asset finance include:

- Equipment leasing

- Finance lease

- Hire purchase agreements

By using existing assets, you could access money that is tied up in your business collateral, such as property or land. Additional assets are new purchases, for example, plant machinery, vehicles and equipment, which you typically hire with the option to purchase at the end of the agreement.

What is a business asset?

A business asset is any item in your business that helps you operate. Assets can be large or small, including commercial property, brand reputation, inventory, and equipment.

Business assets fit into four categories: fixed, current, tangible and intangible. They contribute to the value of your business; you can convert them into cash to fund future growth initiatives, and you can offer them up as collateral to secure business finance. Business assets are very valuable.

How does asset finance work?

Asset finance works by reducing the amount of money a business has to spend when buying new equipment or machinery upfront. Rather than a business having to purchase an asset outright, typically the asset lender will buy the asset and then the business will pay a monthly fee for the duration of the agreed term.

Short-term asset finance lets companies acquire the assets they need, without having to compromise on cash flow. Staying ahead of the competition is vital for business success but funding commercial equipment, vehicles or plant can be incredibly costly.

For this reason, many alternative funding providers offer business asset finance as a way for SMEs to invest in the latest equipment without incurring significant cash flow problems. In whichever sector you operate, be it construction, manufacturing, logistics or printing, investing in new assets could be more affordable than you think.

In most cases, you can spread the cost of equipment over the lifetime of the purchase. Typical short-term asset finance arrangements include hire purchase and equipment leasing. Operating leases are another form of asset finance but you do not have the option to own the equipment once the rental contract has ended. Alternatively, asset refinancing gives you the opportunity to release funds tied up in existing assets.

Why use asset finance?

Asset finance can be used as a short-term funding solution to boost cash in a business and cover everyday operating expenses. There are lots of reasons to consider using asset-based finance. Many businesses use asset finance to help pay costs like employee wages and supplier invoices or to fund expansion plans. It is a popular choice because it is secure and flexible, ultimately you are taking out an asset loan against items you already own.

On the other hand, asset finance is used by businesses that need to update their existing equipment or purchase new machinery. Both types of asset financing help to increase cash flow and save companies money over the long term. It can be used by any type of UK business, from smaller startups to large multinational corporations.

What type of assets can be financed?

Business assets that can be financed through asset funding include:

- Soft assets like computer software, security equipment, materials, fixtures and fittings.

- Hard assets including office furniture, machinery, equipment, vehicles and buildings. Unlike soft assets, these larger items have a resale value at the end of the agreed purchase term.

- Liquid assets that appear on your business’s balance sheet and can be easily converted into cash.

How long is asset finance used for?

Usually, asset finance is used by businesses over a one to seven year period, in which time said company has time to repay the asset purchase cost at the agreed interest rate. When it comes to very expensive assets, asset-based finance can be used for more than seven years.

This type of funding lets businesses choose how much time they need to comfortably make repayments. The length of asset finance will also depend on the amount of time the asset will be used for, as well as the lender's repayment requirements.

How do you finance a business asset?

A lot of businesses just don’t have the cash flow required for big asset purchases, which is where asset finance solutions can help. Whether you are financing a vehicle, machinery, or commercial equipment you firstly need to decide which method of asset-based finance is best for you and your business.

- Decide which type of business asset finance meets your needs

- Determine how much cash your business needs to unlock, or what type of assets you require

- Think about the ideal amount of time you’d like to spend making repayments

- Make an online application to access the best asset finance providers

Maybe you are looking to release cash tied up in an existing piece of equipment or vehicle - in this case then you would look towards straight-forward asset refinancing. Or, you may need access to new business assets in which case you have more choice. There are several ways to acquire the business assets you need without incurring significant upfront costs.

What are the different types of asset-based finance?

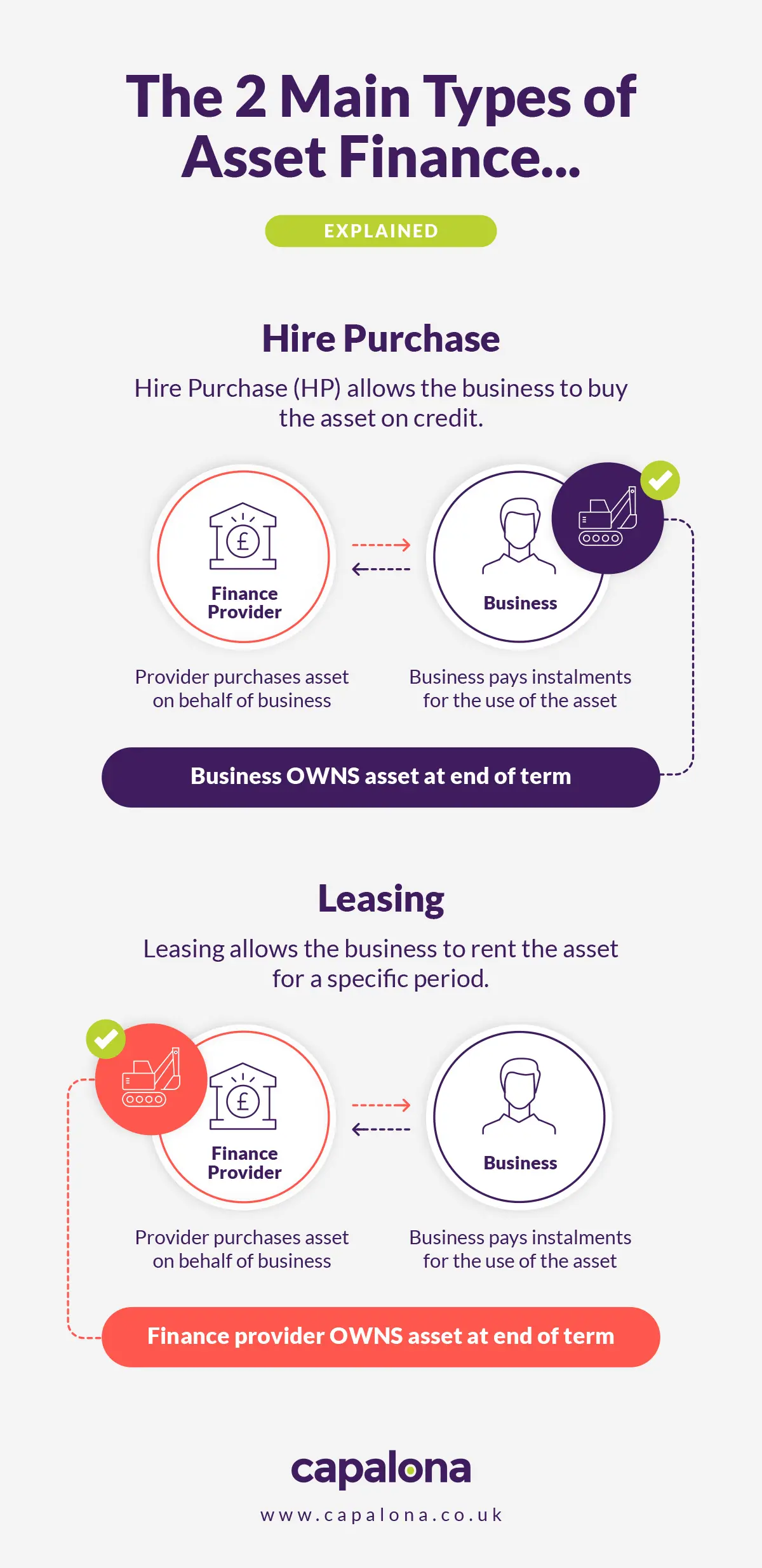

Within asset finance, there are two main types of funding. The first is borrowing to access additional assets, the second is a form of secured business loan that allows you to borrow against existing business assets. Within these broader categories, the main types of asset-based finance include:

Hire Purchase

Hire purchase (HP) is the most popular form of asset finance for businesses that want to spread the total cost of equipment purchase over a longer period.

What is a hire purchase agreement?

A hire purchase arrangement is a simple way of buying business assets on credit. You receive the equipment straight away and then repay the amount borrowed in monthly instalments, so you spread the cost of the purchase over time. Once the loan has been repaid, you will own the asset outright.

Hire purchase agreements are commonly used in sectors that require continuous upkeep of expensive machinery. We find that businesses in the engineering, construction and manufacturing sectors benefit from this type of finance.

Finance and Capital Lease

With a finance lease arrangement, the asset finance company buys the asset for the lessee and remains the legal owner of the asset for the entire duration of the finance lease agreement.

In most cases, a finance lease transfers the risk of ownership of the asset to the lessee and as such it will appear on the balance sheet. Any outstanding rentals will be highlighted as a liability.

At the end of the hire term a finance lease, the asset can be either written down to zero or be set to estimated market value.

Sometimes at the end of the hire term, a business can be offered a secondary smaller lease agreement by the finance company depending on business requirements. A business may wish to use a capital lease as the depreciation allows them to expense the assets initially quicker instead over the entirety of the lease agreement.

Are there tax benefits for finance leases?

Leasing an asset is highlighted as a monthly expense instead of an owned asset on your business balance sheet. This can be a tax-efficient accounting method depending on how your business operates. Leasing options can also include service plans, breakdown cover and other insurance elements vital to keep your business working.

Having such cover means you don't have to worry about large maintenance costs and possible significant downtime. Consult your accountant for the best tax treatment arrangement for your business.

Equipment Leasing Finance

As with hire purchase, equipment leasing finance is a form of asset-based finance. It allows you to use the equipment straight away and spread the cost over an agreed period of time. The difference is that you will not necessarily own the equipment at the end of the term. Instead, you may be able to extend the equipment lease agreement, purchase the equipment outright (factoring in what you have already spent), upgrade it on a new lease or simply return it.

An advantage of equipment leases is that you can upgrade or change your purchase according to your business needs at the end of the agreed term. For example, you may need a larger vehicle, there may be new technology available, or you may simply need more of the machines you purchased. Conversely, it’s really important to think about your timeframe when you take on an equipment lease. You will want to make sure that you are not making repayments on an asset you no longer use.

Operating Leases and Contract Hires

Also known as contract hires, an operating lease is a set, short-term rental agreement and means that you will not own the equipment. The lender is normally responsible for maintaining the equipment, which is typically loaned to other businesses once it has been returned at the end of each term. Operating leases can be a cheaper asset finance option because you won't pay for the full value of the equipment.

Asset Refinance

If your business has capital locked within valuable assets such as property, land or equipment, this cash can be released through a refinancing arrangement.

Also known as capital release, with asset refinance the amount you can borrow is dependent on the value of your asset, which acts as security against the business loan. This means that if you do not meet repayments, the lender takes the asset in lieu of what’s owed.

Asset refinancing is a reasonably flexible asset finance option, and there is a range of financial products available for this type of lending. It’s important to note that with asset refinance, the asset being refinanced must be critical to your business operations.

What are the benefits of asset finance?

Asset financing is popular with businesses in all sectors. As a flexible, low-risk funding option, asset finance offers a number of benefits to businesses:

- Fast access to new equipment or cash tied up in existing assets

- Helps manage cash flow by spreading costs over time

- Flexible lease terms from 1 month to 5+ years

- Fixed repayments and interest rates for clear budget management

- Potential tax advantages depending on the finance method

- Choose what to do with the asset at the end of the lease term

- High approval rates compared to traditional business loans

- Minimal paperwork and quick setup for busy business owners

Asset finance enables you to grow your business using the latest equipment, vehicles and technology. You can choose to invest in new equipment or release funds tied up in existing assets. Funds can be made available relatively quickly with clear terms to ensure your budget is managed effectively.

With leasing, the item counts as a monthly expense rather than an owned asset on the balance sheet, which can be tax-efficient for some businesses too. There are various subtypes of a vehicle lease, so you can decide whether you would like maintenance and insurance to be included and whether you need the item for its whole working life or a shorter period.

Is asset finance the same as invoice finance?

With many funding options and finance packages available, it’s easy to get confused. Invoice finance is a form of asset-based lending but the two options are commonly muddled up.

For companies who need to scale quickly and access funding for growth, Asset-based lending (ABL) is often used by utilising assets such as invoices, machinery, manufacturing equipment, commercial property and other business inventory as the security for the business loan.

While asset finance depends on using existing or additional assets as security, invoice finance is lending based on the number of outstanding invoices a business has. Rather than waiting for a customer to pay an invoice, a lender will advance you a percentage of the invoice amount. This avoids cash flow issues and does not dilute your equity.

Which industries benefit from asset finance solutions?

If you’re unsure of whether asset finance is right for your company, we have outlined sectors that commonly benefit from asset funding and shown how businesses have used such solutions in the past.

Construction Asset Finance

Construction asset finance simply provides your business with access to purchase of all types of industrial equipment needed for growth, such as cranes, excavators, loaders, crushers, trucks and much more.

If you have assets of your own, you can quickly release capital locked up in them, giving you that additional cash boost that your business needs.

Asset finance can be used for most construction equipment, including:

- Heavy and Light Earthmoving Machinery

- Trucking and Hauling

- Paving and Compacting

- Drilling and Piling Equipment

- Lifting and Material Handling

Gym equipment finance

Starting or expanding a fitness or gym business in the UK can be expensive, especially as a single piece of gym equipment can cost thousands to finance yourself. There are many gym equipment financing options, however. By using equipment leasing you can get the fitness equipment installed without delay. What's more with this method of asset leasing you can keep upgrading the gym machines whenever you need to.

The best part, maintenance and full servicing are usually included in the lease agreement. This assurance gives you the peace of mind that you won't be stuck with a broken gym machine causing downtime, or having the need to re-sell to buy new kit.

Van Leasing and Finance

It's a fact that transport and logistics asset finance plays a vital role for businesses who need to be on the road. Many small businesses such as plumbers, builders, electricians, joiners and delivery businesses all need a Van to make their business work. So why buy when you can lease a van for your business? Van leasing and Van Hire purchase or even a combination of both are options that you can consider.

Manufacturing & Machinery Finance

Manufacturing finance is a flexible way to access new equipment or machinery that you need for growth. It improves cash flow and enables you to purchase many types of manufacturing equipment, including plant, packaging food machinery and more. If your business already owns high-value assets, you can simply release capital tied up in them, giving you that much-needed cash injection.

Asset finance can be used for the majority of manufacturing equipment, including:

- Plant Machinery

- Packaging Machinery

- Printing Machinery

- Plastic Machinery

- Food Processing Equipment

- Food Mixing Machinery

Asset finance can even unlock the capital in existing assets for immediate cash flow requirements or more equipment purchases.

Agricultural Finance

Agriculture asset finance is a flexible solution for your financial growth requirements. It gives you access to purchase many types of farming and forestry equipment, such as tractors, combine harvesters, spreaders and more, helping you to invest in the latest high-tech equipment. If you own assets, you can essentially borrow money against the value of them, quickly releasing the cashback into your business.

Asset finance can be used for most agricultural machinery, including:

- Tractors

- Planting and Seeding Equipment

- Harvesting Equipment

- Front End Loaders

- Cutting and Shredding equipment

- Forestry Machinery and Equipment

You can also use our business loan repayment calculator to get an idea of funding costs.

Company Car Leasing

We help to arrange asset finance for cars and company vehicles. Luckily, there are many company car leasing options available to small businesses in the UK. Whether you are looking for a single car lease or leasing a car through a limited company, we can help. You'll be leasing the car for a set amount of time, with a set number of miles, at an agreed fixed monthly fee. At the end of the term, you return the car or start a new contract. You never actually get to own the vehicle, it is classed more like a long-term rental.

We also specialise in fleet leasing, hire purchase and finance leases each of which has its own set of advantages and disadvantages depending on your requirements.

Transport and Logistics Finance

Transport and logistics asset finance can help your business refinance or purchase new vehicles such as buses, cars, trucks, vans and much more, allowing you to spread the cost instead of buying outright. It’s a flexible solution that improves cash flow by keeping your working capital free.

Companies who use heavy goods vehicles for their day-to-day operations know that the upfront costs to purchase such vehicles can be incredibly high. It is just not cost-effective for businesses to buy vehicles outright. Even larger SMEs and logistics companies all look towards better financing through HGV leasing companies.

The big advantage is that you can upgrade the truck or HGV. You can even have a sale and leaseback where you can own the vehicle, renew it or give it back to the lender. Some options include:

Hire Purchase

Hire Purchase where you eventually own assets once you have repaid all the fixed monthly repayments. This is a great option if the intention is to gain ownership of the asset at the end of the term.

Sale and HP Back

A method of unlocking the cash in your own asset and then hiring the vehicle back from the lender. You'll not own the asset any more, but you've released cash which you can use in your business and you can remain using the asset but within a hire arrangement.

Computer and IT equipment leasing

Businesses based in the UK can access IT software and hardware technology using lease finance without the requirement to buy. It is especially attractive for this type of acquisition as technology is always changing. Technology gets updated, faster computer systems and steadily improving software packages can quickly leave older systems redundant and slow.

By using lease finance, you can stay ahead of the game, replacing new computer kit and software solutions for better efficient solutions without the need to purchase outright. There are many types of business equipment that you can take through asset finance. These include:

- Laptop PC's

- Desktop PC's

- Apple Mac leasing

- Software

- Photocopiers

- Printers

- Office Furniture

- CCTV

- Point of Sale Systems (EPOS)

Catering Equipment Finance

By using asset finance you can access the latest catering equipment on the market whilst preserving your working capital. There's no need to outlay initial costs to buy kitchen equipment for a café. It can be more effective to use asset finance for a whole range of catering needs. From cooking equipment, cold storage and refrigeration, coffee machines, pizza ovens, dishwashers, cash registers - even vehicles that you may need for food delivery or events.

Maybe you are looking to do a full refurbishment or a new fit-out of your premises there is a flexible finance option to suit your business needs.

Does my business qualify for asset finance?

To qualify for asset finance, you must operate a UK based limited company with a turnover more than £10,000. The asset loan funds must be used for business use only.

Choose Capalona to arrange your business’s asset funding

With so many asset finance solutions out there, making the right choice can take time. Capalona can help you navigate the road of asset financing by finding the best options for your business's needs in minutes.

As a leading online asset finance broker, we've helped many businesses find suitable asset-based lending solutions in the UK. Our free-to-use business finance matching platform will help connect you to the right providers for your needs.

At Capalona, we only work with reputable UK-based asset finance companies. After making an application, you'll be able to see and compare the funding options that are most suitable for your business.

Adrian T

5/5

Amazingly fast, efficient service, minimal paperwork. So much faster than my business bank of twelve years.