If you struggle to pay bills or simply want to know what liquidity in business is, this blog is for you.

Here, we're exploring the meaning of liquidity and alternative financing options to avoid liquidation if you want to keep your business running.

What’s the meaning of liquidity in business?

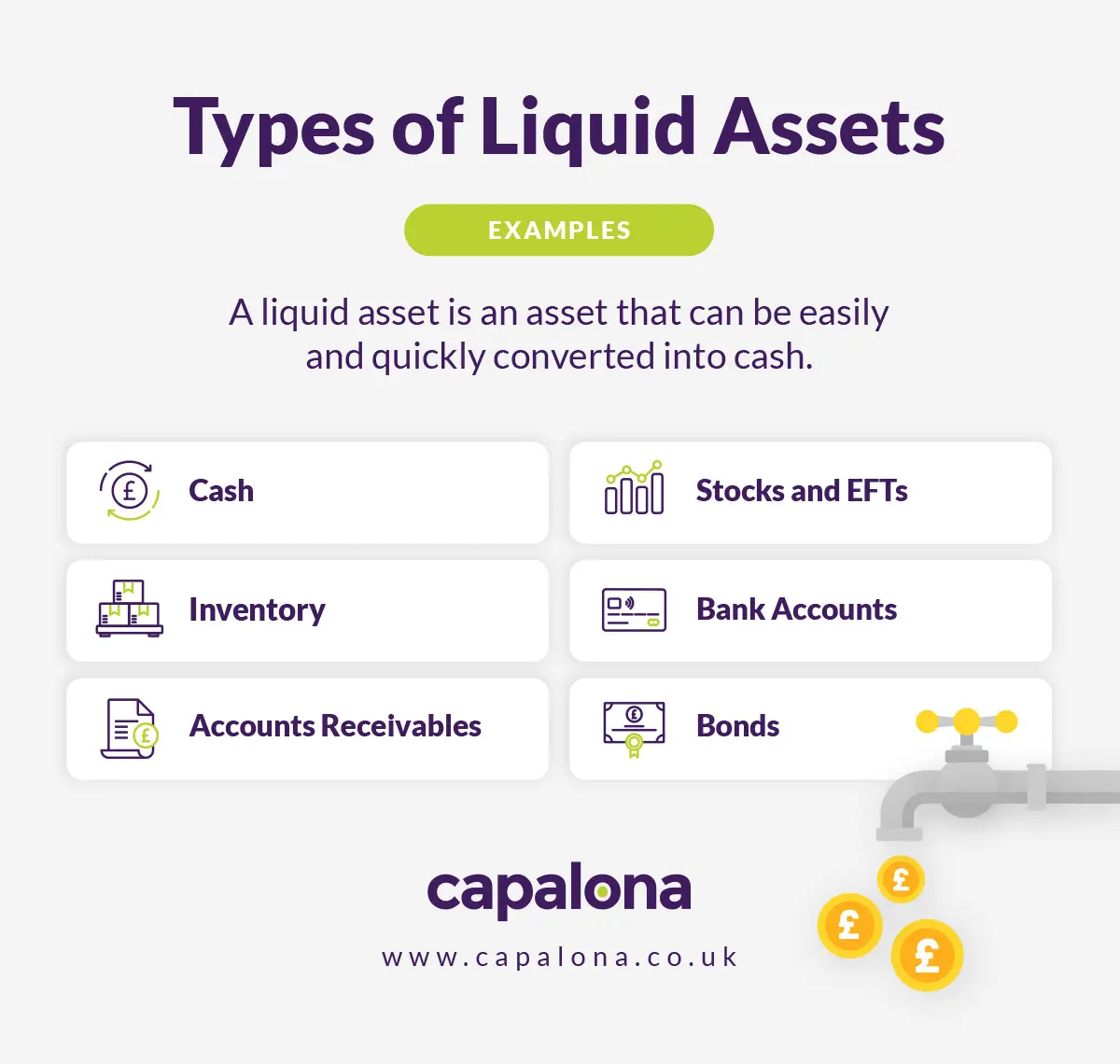

Liquidity is a measure of how well a company can turn liquid assets into cash quickly (I.e. accounts receivable, cash, inventory, etc.). Liquidity is measured in ratios, namely, a current ratio or a quick ratio and gives an immediate snapshot of a company's financial health.

If a company has low liquidity, it can indicate financial trouble, whereas high liquidity suggests financial stability.

How to work out business liquidity

There are a few ratios you can use to measure liquidity. The two most common ratios are current ratio and quick ratio.

Current Ratio = Current Assets ÷ Current Liabilities

If you get a ratio above one, this can indicate you have good liquidity. This means you can comfortably cover short-term obligations like accounts payable and wages, meaning you can comfortably manage business finances.

Quick Ratio = Quick Assets (Cash + Accounts Receivables) ÷ Current Liabilities

Again, a ratio above one is a good indicator that the company has enough liquidity to cover immediate liabilities. The quick ratio typically excludes inventory, as it may take longer to convert into cash compared to other current assets.

Here's an example:

| Current Assets | |

| Cash | £5,000 |

| Accounts receivable | £10,000 |

| Inventory | £5,000 |

| £20,000 | |

| Current Liabilities | |

| Accounts payable | £10,000 |

| Short-term debt | £3,000 |

| Accrued expenses | £2,000 |

| £15,000 | |

| Current Ratio = £20,000 (Current Assets) ÷ £15,000 (Current Liabilities) |

1.33 |

| Quick Ratio = £15,000 (Cash + Accounts Receivables) ÷ £15,000 (Current Liabilities) |

1.00 |

What does liquidation mean?

Liquidation is the process of closing a company by selling assets to repay debts. This legal process happens if the business is unable to meet its financial obligations, even after exhausting every avenue.

You can categorise liquidation into two types: compulsory and voluntary.

Compulsory Vs voluntary liquidation

Compulsory liquidation is court-ordered, whereas voluntary liquidation is when the legal process is started by the company itself.

Once either type of liquidation is complete, the company no longer exists, and any remaining assets are distributed to shareholders.

Where can I seek advice on liquidation?

The best person to seek liquidation advice is from a licensed insolvency practitioner. You can search for practitioners in your area by using the Government's Insolvency Services Directory.

Funding options to keep your business running

As a business owner, it's daunting to find yourself in a position where you struggle to pay debts. But there are some funding options available you can use to help rebalance cash flow and boost working capital to get back on track.

Here, we're exploring just three of them.

Secured business loan

If you're looking for a large lump sum, a secured business loan can help you reinvest in your business. You receive the money as one sum into your bank account, and repay it in affordable monthly instalments, with interest.

Secured loans can help you make big changes in your business; perhaps you want to diversify to increase your monthly revenue or want to consolidate your debt into one monthly repayment.

You can secure a loan with an asset such as property, equipment or vehicles. By securing the loan, you can unlock high loan amounts, lower interest rates and long-term repayment periods - up to, or sometimes exceeding 10 years.

Merchant cash advance

If you take credit or debit card payments, a merchant cash advance offers a flexible lending solution based on your future card sales. Applying for a cash advance can help you restore some much-needed working capital, helping you get your finances back on track.

Secure up to £300,000 and repay in flexible payments as a percentage of your sales. This helps keep your loan repayments in line with your business growth. Repay more on successful months and less on slower months.

Invoice financing

If you find yourself struggling with cash flow, invoice finance can help you rebalance the scales by releasing funds tied up in unpaid invoices. You can release up to 95-100% of the total unpaid invoice amount in exchange for a fixed fee or a percentage, depending on the lender.

Simply upload your invoices to a dedicated platform and draw down funds as and when you need them.

How can Capalona help?

At Capalona, we can help you find and compare your business financing options.

Our self-serve tool makes the process of finding affordable finance a doddle. Simply share a few details and instantly compare your eligible options. Compare business finance.