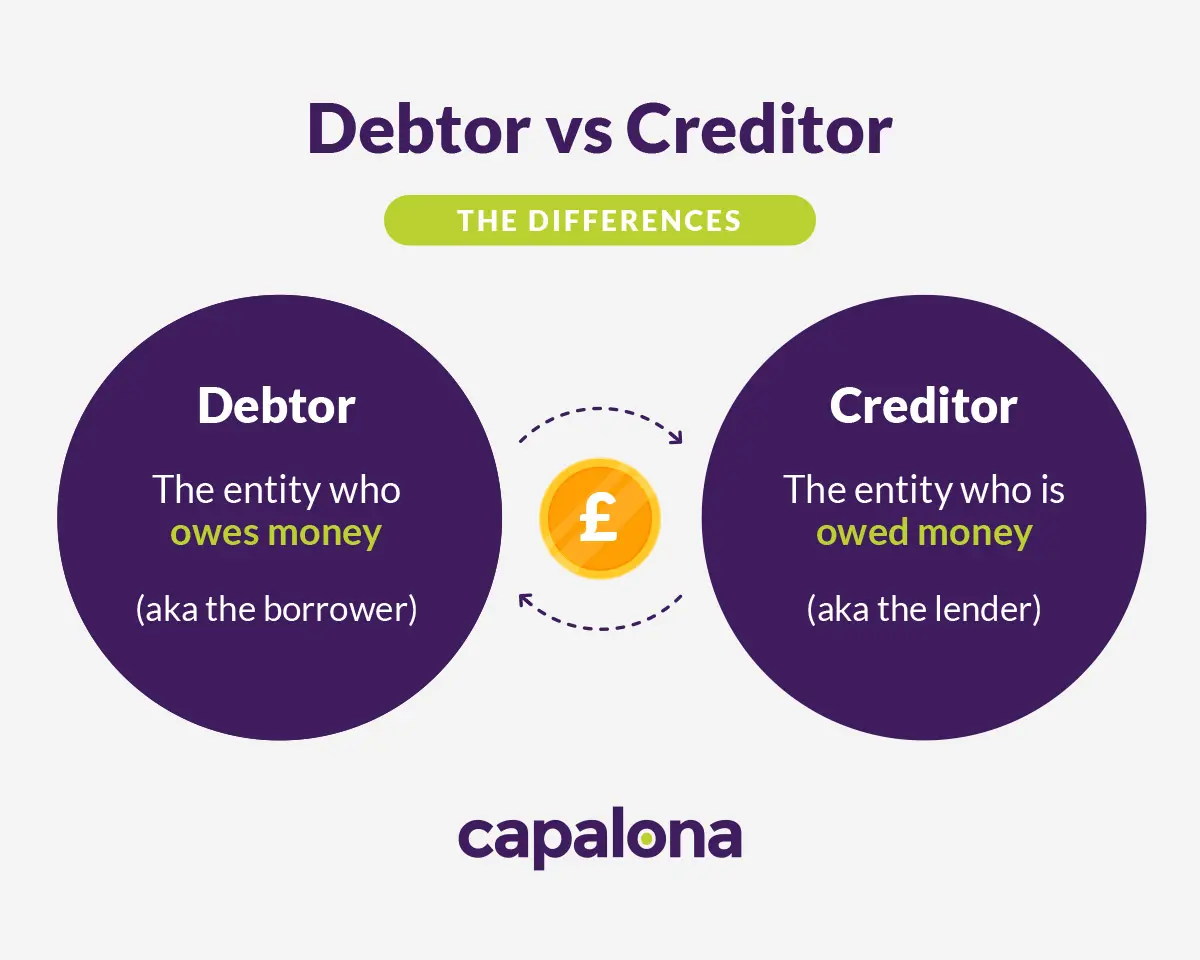

In short, a debtor is a person who is in debt and owes money, and a creditor is a person who is owed money. So, if you apply for a business loan, as the borrower, you become the debtor, and the lender is the creditor because you owe the lender money.

If you have questions about your obligations as a debtor or creditor and want to understand how the two work together in a credit relationship, keep reading.

What is a creditor?

A creditor is a person or entity that offers credit to another person or entity. For example, that credit could be in the form of a loan or an invoice. So what do creditors do? They’ll lend money to the business or person (the debtor) and expect repayment within a certain period. So if you invoice a customer for goods or services delivered, you might expect payment within a 30, 60 or 90-day period.

Creditors usually charge interest on the payment, mainly when the credit in question is in the form of a business loan or a mortgage, for example.

What is a debtor?

A debtor is a person or entity that has taken on the debt, i.e. if you apply for a loan to help with cash flow issues or someone invoices you for a service they’ve provided. Until you repay that debt, you are the debtor, and this debt sits in your accounts payable. As a debtor, you might owe money to banks, alternative lenders, individuals or companies, and these debts can be loans, mortgages, credit cards or invoice payments.

When you owe money to secured creditors, this is where you risk an asset, i.e. when you take out a mortgage. If you can’t repay your mortgage, the creditor (mortgage lender) can repossess the house as they hold a lien (a legal claim) against the property. It’s worth noting that secured creditors have priority debt collection over unsecured creditors.

As long as you understand your obligations as a debtor and repay the debt within the specified payment terms, you’ll maintain a healthy credit score and face no legal action or additional consequences.

What happens if a debtor can’t pay a creditor?

Negotiation is the first port of call when a debt hasn’t been paid. This happens through simply communicating with the debtor and understanding why the credit hasn’t been repaid. As a result of this negotiation, the creditor might consider a new payment to help the debtor better manage repayments, i.e. extending their repayment period or making changes to the debt terms.

If the creditor and the debtor can’t reach an agreement, e.g., with a new repayment plan, the creditor might use a debt collection agency before taking legal action against the debtor. Sometimes, even just receiving a letter from a debt collection agency can be enough to elicit payment from the debtor.

If the creditor prefers, they can take legal action against the debtor instead. This can include mediation, court action, or even insolvency proceedings where the debtor’s property could be repossessed, and they would struggle to reaccess credit in the future.

If you’re struggling to collect credit repayments from a debtor, we advise you to speak with a debt recovery solicitor for professional advice.

Debtors and creditors examples

Let’s say you’re a business owner running a cafe, and your coffee machines stop working; they’re expensive to purchase outright, so you approach a lender to set up equipment finance. Now, you can purchase multiple coffee machines on a lease basis to get your business back up and running. In this credit relationship, you are the debtor, and the lender is the creditor because you’re the one who owes the lender money.

You then get a phone call from an event planner who wants to purchase a large order of your handmade coffee cakes. Instead of paying for them outright, you invoice the event planner for the order total. In this instance, you have become the creditor, and the event planner is the debtor as they owe you money.

You can see how quickly a business can assume both roles as debtors and creditors.

Looking to grow? Our business funding solutions are an affordable and flexible option for ambitious small businesses. From same day loans to invoice finance and equipment financing — get a quote today and see how much you can lend.