If you’re taking out a secured business loan, the lender will secure it with either a fixed or floating charge. But what exactly is a floating charge, and how does it work?

Managing business finances can be overwhelming, particularly when there are so many financial terms to get your head around. This blog explores the definition of a floating charge and when one might be used.

Floating Charge Meaning

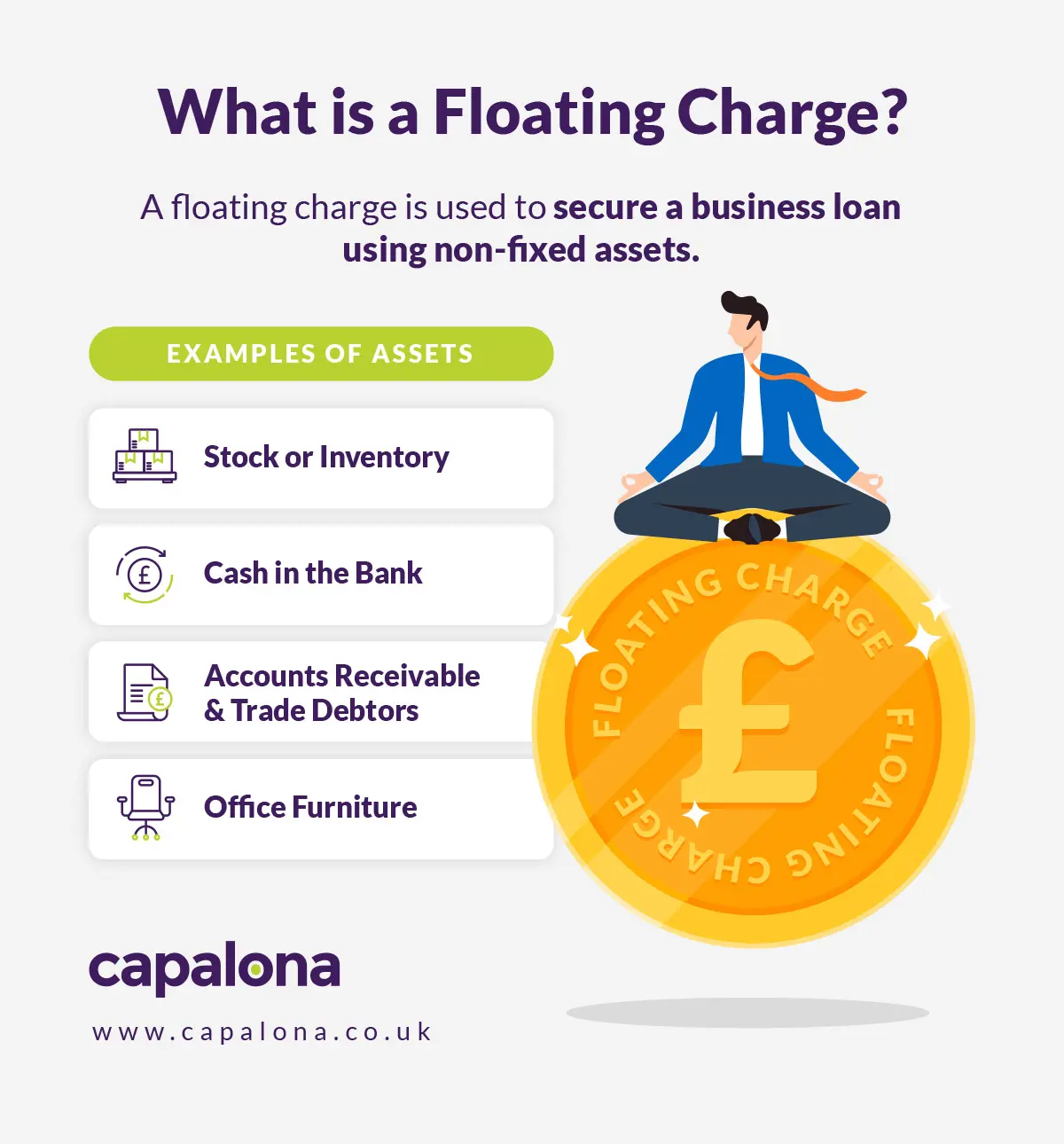

A floating charge, also known as a floating lien, is a way to secure debts without using fixed assets (like machinery or property). Instead, a floating charge refers to all current non-fixed assets, things like stock or inventory.

Non-fixed assets can change in value and quantity over the lifetime of your loan; therefore, most lenders will prefer you secure your loan using a fixed charge rather than a floating lien.

Examples of floating charges

- Stock or inventory

- Cash in the bank

- Accounts receivable (money owed to the company)

- Trade debtors (debts owed to the company for products or services delivered)

- Office furniture

The definition of a fixed charge

A fixed charge is the kind of charge on most business loans. This is because the lender must ask permission from the lender before selling or disposing of the asset, making the loan agreement much less risky. Learn more about fixed charges.

Floating charge versus fixed charge: what’s the difference?

Aside from a fixed charge referring to fixed assets and a floating charge as non-fixed assets, what are their main differences?

- With a floating lien, you can still use, sell, and transfer your assets without the lender's permission. With a fixed charge, you must get lender permission before doing any of that (unless you have repaid the debt in full).

- Floating charges are classed as lower priority debt, so if your business runs into financial trouble, i.e., becomes insolvent and is unable to pay debts, lenders with fixed charges will receive their repayments before the floating charge lenders.

- If you can secure your loan with a floating charge, this will give you more flexibility over all your assets, putting you in a better position to grow your business with improved liquidity and increased operational efficiency.

What is floating charge crystallisation?

A floating charge can crystallise, which is when the floating lien turns into a fixed charge if you don’t fulfil certain contractual obligations or your company is liquidated, for example.

When securing a loan with an asset, the borrower will sign a formal loan agreement called a debenture. The debenture, registered at Companies House, will outline the terms of the loan, including interest rate, amount borrowed, assets used as security and details of the fixed or floating charges and can serve as a legal document. I.e. If you default on repayments, the floating charge can crystallise and you lose the opportunity to transfer or sell your assets without lender permission.

Applying for a secured business loan gives you a boost in working capital, which means you can reach your business goals quicker, taking calculated risks by investing in new markets or trying out new products.

There are plenty of other business funding options that don’t require security, so if you don’t want to put your assets at risk, consider an unsecured business loan instead!

At Capalona, we help thousands of UK SMEs find and compare eligible business loans in seconds. Use our self-serve loan comparison tool to get a free quote today.