A sole trader is someone who is self-employed, owning and running their business as an individual. Basically, there is no legal distinction between the business and the business owner — they are one entity. Becoming a sole trader is one of the easiest ways to set up a business.

Setting up as a sole trader is a popular way to structure a business, with 3.1 million businesses in the UK listed as sole traders, which is 56% of the total 5.5 million companies that make up the UK’s economy.

So if you’re thinking of becoming a sole trader business, read on to learn more about the advantages and disadvantages and how you can get started.

Examples of sole traders

You can become a sole trader if you’re working as an individual. Sole traders could include:

- Personal trainer

- Freelance graphic designer

- Marketing consultant

- Taxi driver

- Gardener

- Photographer

- Mobile hairdresser

- Horse Trainer

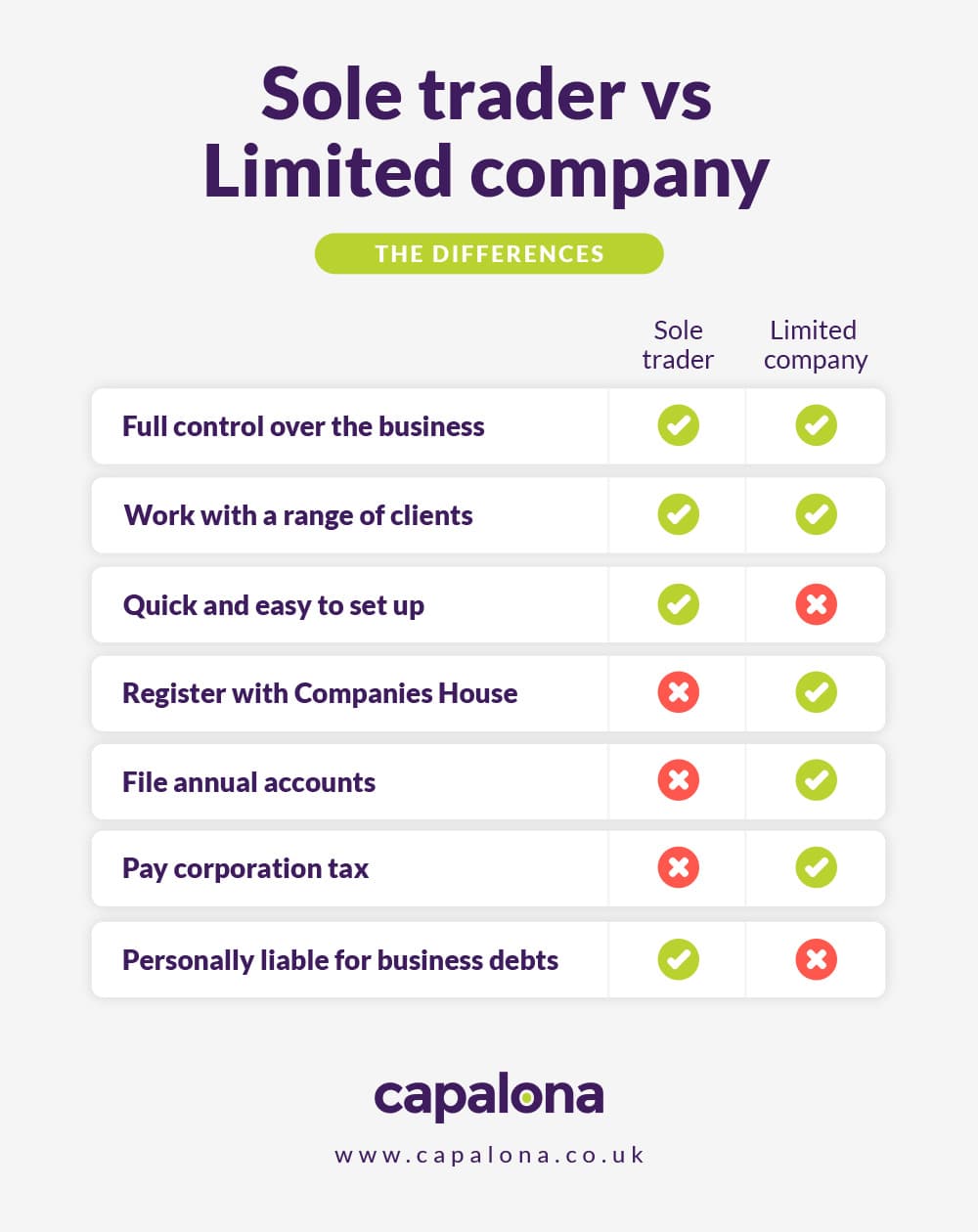

Sole trader vs limited company

To find out more about Sole Traders vs Limited Companies, click on the image below.

Advantages of becoming a sole trader

- You can start working straight away - Simply register for self-assessment with HMRC as a sole trader — you don’t have to register with Companies House.

- Less admin and fewer tax complications - As you just complete one self-assessment tax return, it’s quicker and easier to pay taxes. If you become VAT registered, you just pay this quarterly.

- Full control over the business - Make all business decisions yourself without taking into account shareholders or directors. After taxes, you get to keep all the money you make yourself.

- Financial privacy - Unlike with a limited company, a sole trader’s financial information is kept confidential.

Disadvantages of sole trader ownership

- You’re personally liable for debts or losses - As a sole trader, you are personally liable for any debts or losses incurred by the business. This means if you run into financial difficulties, you could lose personal assets like your house.

- You might find it more difficult to raise capital - As a result of unlimited liability, you might find it more difficult to raise capital as a sole trader, as you pose a greater risk to banks and alternative finance lenders.

- You can look less credible - This entirely depends on what kind of customers you’re targeting, but to some, sole trader status doesn’t always instil the same level of confidence as a business with limited status.

- You have to manage everything yourself - As a sole trader, the buck stops with you, which can be empowering, but also daunting. With no one else to rely on, you might find it difficult to take time away from the business, for example.

How to get set up as a sole trader

Setting up as a sole trader is quick and easy — simply register for self-assessment here. You should notify HMRC as soon as possible after you’ve started trading. And you only have to register for VAT if your turnover reaches £85,000.

3 things to consider when starting your sole proprietorship

You’ll have to learn to wear many hats

As a sole trader, you will be responsible for the whole upkeep of your business, from submitting an annual self-assessment tax return and paying national insurance to marketing your business and invoicing clients. You’ll have your hands full, so be prepared.

Consider opening a separate bank account

Although not a legal requirement for a sole trader, it’s useful to set up a sole trader bank account. Keeping your personal finances separate from your business finances makes filling in your tax return much easier.

Don’t forget to put aside money for your tax

As a sole trader, you’ll have to remember to put aside money for your end-of-year taxes. It can be tempting to spend the money staring at you in your tax savings account but don’t do it — you’ll regret it once 31st January rolls around.

Once you register your sole trader business, an injection of working capital can help you get it off the ground. At Capalona, we help you compare the best sole trader business loan deals. Our comparison tool is free, and there’s no obligation to accept any quotes - apply today.