Bridging Loan

Buy your next commercial investment property before waiting on the sale of another property with a bridging loan. Get your quote below.

- Compare a wide range of lenders and rates

- Check your eligibility in minutes

- Find out how much you could borrow

It's fast, free and won't affect your credit score

- What is a bridging loan?

- How does a bridging finance loan work?

- Bridging Loan Interest Rates

- What can you use a bridging loan for?

- What are the different types of bridging loans?

- What are the advantages and disadvantages of a bridging loan?

- Can you get a bridging loan with bad credit?

- Bridging loan calculator

- How to get a bridging finance loan

- Bridging Finance Comparison

- FAQs for Bridging Loans

- Why choose Capalona?

What is a bridging loan?

Popular with property investors, landlords and developers, a bridging loan ‘bridges’ the gap between buying and selling a property. If you see a property you want to buy at auction, a bridging finance loan can help you purchase it if you haven’t yet sold your current property.

Commercial bridging loans are short-term finance, and are usually paid back within 12 months – so you won’t be paying it back for years like with some traditional loans.

What can you use a bridging loan for?

You can use a bridging loan for lots of reasons; they’re incredibly useful if you’re a property developer, investor or landlord. It can be challenging to buy a new property before your other one has sold, and getting a commercial mortgage is now a longer, slower process than it once was – a bridging loan can free up funds so you can put an offer in on your next property.

You could use a commercial bridging loan for:

- Buying properties at auction

- Funding Property development, refurbishment or conversion work

- Commercial property or semi-commercial unit purchase

- Investment purchases such as a buy-to-let

- Buying inhabitable property

- HMO purchase

- Property refinance

- Land purchase

Bridging finance means you can act fast and grow your property portfolio quickly – buy that time-sensitive house you’ve had your eye on, or renovate your current property before selling it. A bridging loan for property development can be handy.

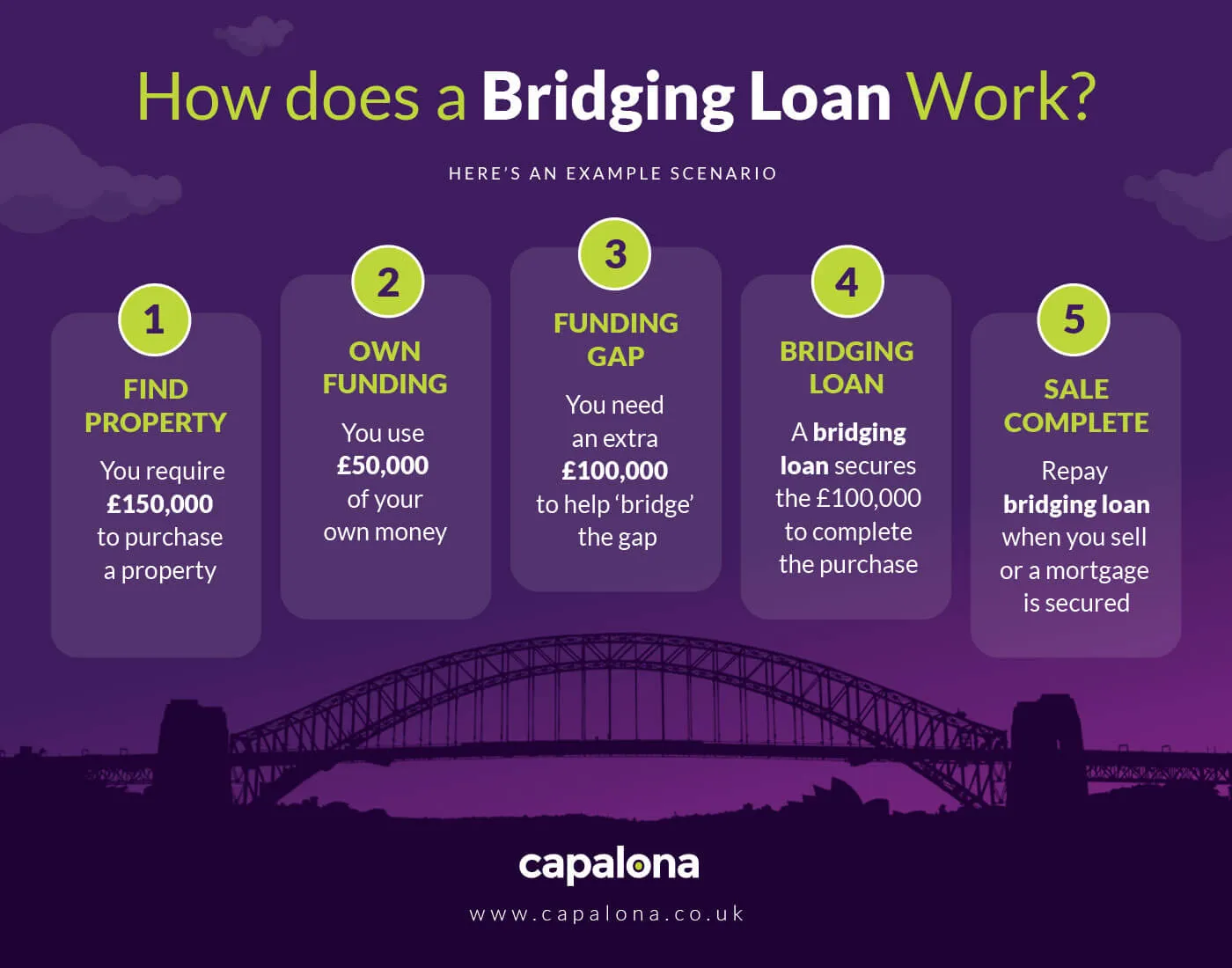

How does a bridging finance loan work?

A bridging loan for business is a secured loan, which means you’ll need a high-value asset to get one. This finance isn’t paid back in monthly instalments like other finance; the bridging lender receives payment when you either sell your property or secure other sources of funding such as a long-term mortgage.

Bridging loan example

- A developer is looking to purchase a property worth £150,000 to renovate and sell on.

- They have £50,000 to put towards the purchase.

- They require an extra £100,000 to ‘bridge’ the gap.

- A bridging loan is used to secure the additional £100,000 needed to complete the property sale.

- The bridging loan is repaid once the property has been sold or the developer has sourced longer-term funding.

Bridging Loan Interest Rates

There’s no getting away from the fact that bridging loans are expensive.

The interest rates on these types of loans are high and could range between 0.5% and 1.5% each month. Each lender’s interest rates will differ, and that’s why comparing bridging finance loans is key to finding the best loan offer.

Bridging finance loan rates can seem high

Because of its short-term nature, bridging finance is mainly charged with monthly interest rates rather than an annual percentage rate (APR). This means differing interest rates, no matter how small, can make your loan much more expensive.

You’ll also need to be aware of additional loan fees, which can be up to 2% of the loan amount. Keep your eyes peeled for an arrangement fee, admin fee, legal fees or valuation fees. You must know what fees apply to your loan so you can work out whether you can realistically afford the loan plus fees and interest.

Bridging loan interest rate example

To get an idea of the cost, here are some quick examples of interest rates on a typical £100,000 bridging loan over 1, 3, 6 and 12 months.

| Interest Rate | 1 month | 3 months | 6 months | 12 months |

|---|---|---|---|---|

| 0.50% | £500 | £1500 | £3000 | £6000 |

| 0.75% | £750 | £2250 | £4500 | £9000 |

| 1.00% | £1000 | £3000 | £6000 | £12000 |

| 1.25% | £1250 | £3750 | £7500 | £15000 |

| 1.50% | £1500 | £4500 | £9000 | £18000 |

These costs don’t include other fees such as facility fees, valuation fees, admin or legal fees that you might have to pay in addition to the interest payments.

Early Repayment of Bridging Loans

A bridging loan is usually set up for 12 months with no early repayment or exit fees. So, if you’re in a position to repay early, for example in 6 months 20 days from drawdown, you will only be charged for the actual time you use it with no penalties.

What are the different types of bridging loans?

There are two types of bridging loans, ‘closed’ and ‘open’. Whichever loan you choose the lender will require you to share a repayment strategy. How do you plan on repaying it? Are you selling a house? Are you waiting for a mortgage? They’ll want clear evidence of how you’re planning to repay them.

Closed bridging loans

A closed loan is an option if you’ve already exchanged contracts and you’re waiting for the sale to go through. This loan has a fixed repayment date because you know when it’s likely to finish.

With a closed bridging loan, you will need to provide a clear exit strategy that summarises how the short-term loan will be repaid at the end of the agreement.

Open bridging loans

An open loan means you don’t have a fixed repayment date. Although there’s no fixed date, you’d usually have to pay it back within 12 months. It also means that you do not need to present the lender with an exit strategy. However, without an exit plan, an open bridging loan may work out much more costly.

Choosing the best bridging loan for you

Before you think about comparing bridging finance lenders, think about these things first:

- How much you want to borrow.

- What is the property’s value? This will dictate how much you can borrow.

- How long do you need to borrow the loan for?

What are the advantages and disadvantages of a bridging loan?

As with any form of finance, there are pros and cons of bridging loans. Before you dive head first into a new loan contract always explore all funding options available to your business.

Advantages of a Bridging Loan

- Quick funding – bridging finance is quick to set up. They’re in a competitive market, so funds are freed up pretty sharpish.

- Flexible borrowing – you only pay for the time you use it for.

- All credit ratings are welcome – if you’ve got a less-than-perfect credit score, you can still secure a commercial bridging loan.

- Used to buy auction properties – with a bridge loan, you can buy properties at auction quickly within a short period even if they are derelict or inhabitable.

Disadvantages of a Bridging Loan

- Property at risk – as the bridging loan is secured against one, or in some cases, multiple properties, there is a risk of losing them if you can’t repay.

- High interest rates – high interest rates make this type of loan a much more expensive finance option.

- Unregulated – commercial bridging loans are currently unregulated, so there can be hidden charges.

- Additional costs – some lenders may charge for admin fees or legal fees.

Can you get a bridging loan with bad credit?

Yes, you can get a bridging loan with bad credit. Unlike other forms of financing, credit scores aren’t the priority criteria for bridging loan lenders. Instead, they’re more interested in the security put forward by the borrower. The lender gets paid back when you refinance or sell your property.

Bridging loan calculator

Use a commercial bridging loan calculator to quickly illustrate the likely cost of bridging finance, including repayments, interest and other associated fees. This helpful tool can be used to compare other bridging loan offers you may have.

Calculate the cost with a free bridging loan calculator.

How to get a bridging finance loan

The process at Capalona to secure bridging finance is quick and easy. After completing our short online form, we’ll instantly display your eligible lenders. Simply compare your options, then select the providers you would like to proceed with to request a quote, and they will contact you directly via phone or email.

All quotes you request are free of charge, and you are not under any obligation to accept any lender quote.

If you do want to move forward with a lender’s loan offer, you’ll work with them directly to secure your finance.

Bridging Finance Comparison

We serve to help you find the best funding for your business, and that means comparing offers. We work with a variety of UK-based lenders, who are just waiting to share their best loan offers with you.

The beauty of our service is that you can collect lender quotes without the legwork, you’ll then receive your free quotes, and there’s no obligation to accept any of them.

What have you got to lose? Compare bridging loan providers now.

FAQs for Bridging Loans

These loans can range from £25,000 to over £100 million, in some cases, so it just depends on what you need for your business, what your credit rating is, and the value of the property you want to purchase.

Most bridging lenders will typically offer a loan to value up to 75% of the property, but may be more depending on the security involved.

Yes, some lenders may be able to offer 100% (LTV) bridging loans without having to put down a cash deposit, but they may require you to use additional commercial properties or assets as security. A 100% loan to value will cover the total cost of the property purchase.

Commercial bridging loans can be arranged exceptionally quickly; in most cases, within 24 to 48 hours. However, it may take longer, and it’s not uncommon for the process and funds to be completed within 7‐14 days.

First Charge Bridging Loans

A 'first-charge' is the loan that takes precedence over any other finance secured against the property. If you took out bridging finance to pay off an existing mortgage, the mortgage would become fully paid, and your bridging finance would become a first charge against your property.

Second Charge Bridging Loans

A 'second-charge' bridging loan sits behind an existing loan or other finance on your property, such as a mortgage. If your house already has a mortgage, the mortgage takes priority over any other finance in terms of repaying debt. The bridging loan would be second to be paid off in this instance.

Some lenders will consider offering finance as a second-charge, they’re assessed on an individual basis.

The Financial Conduct Authority (FCA) is responsible for regulating the financial services industry in the UK. This regulation gives protection to consumers and promotes a fair market. However, not all bridging loans are protected; here are the differences between an unregulated and regulated bridging loan:

Unregulated Bridging Loans

A bridging loan that is secured on property or land that will not be lived in by the borrower or an immediate family member is unregulated. This could be a commercial acquisition, such as a buy-to-let, investment property or commercial real estate.

Regulated Bridging Loans

Regulated bridging loans are secured against a property that is lived in, or soon to be occupied by the borrower or immediate family member.

Although we only work with commercial bridging loan lenders, most of them are FCA-regulated, as they will offer regulated bridging loans.

If you’re not sure if commercial bridging finance is the right option for your business, you might want to consider:

- commercial business loans

- secured loans

- commercial mortgages

- personal loans

- a second mortgage

- or remortgaging your current home to release funds

Why choose Capalona?

There are so many loan products on the market, so finding the right one for your business can be challenging. At Capalona, we’ve helped 1000s of SMEs secure the funding they needed to help their business thrive.

We help businesses find the best-fit financing for their needs. Whether it’s plugging a monetary gap left by unpaid invoices, to assisting companies to maintain healthy cash flow all year round, regardless of business type.

We’re a digital broker, which means customers can use our comparison service completely free of charge.

Some bridging loan lenders will only work with brokers, rather than directly with the business, so using a broker could be your only way of securing the finance you need.

THINK CAREFULLY BEFORE SECURING DEBTS AGAINST YOUR COMMERCIAL PROPERTY OR HOME. YOUR COMMERCIAL PROPERTY OR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON A MORTGAGE OR ANY OTHER DEBT SECURED ON IT.

Adrian T

5/5

Amazingly fast, efficient service, minimal paperwork. So much faster than my business bank of twelve years.