Growth Guarantee Scheme

The government’s Growth Guarantee Scheme (GGS) is the successor to the Recovery Loan Scheme (RLS), which was established in April 2021 and ended in June 2024. It will provide between £1,000 and £2m to UK businesses to stimulate growth.

- Compare a wide range of lenders and rates

- Check your eligibility in minutes

- Find out how much you could borrow

It's fast, free and won't affect your credit score

What is the Growth Guarantee Scheme?

The Growth Guarantee Scheme is a government-backed scheme that replaces the Recovery Loan Scheme (a loan scheme launched during the pandemic to help fledging businesses recover). It launched on 1 July 2024 and helps support small business growth in the UK by offering loans up to £2 million.

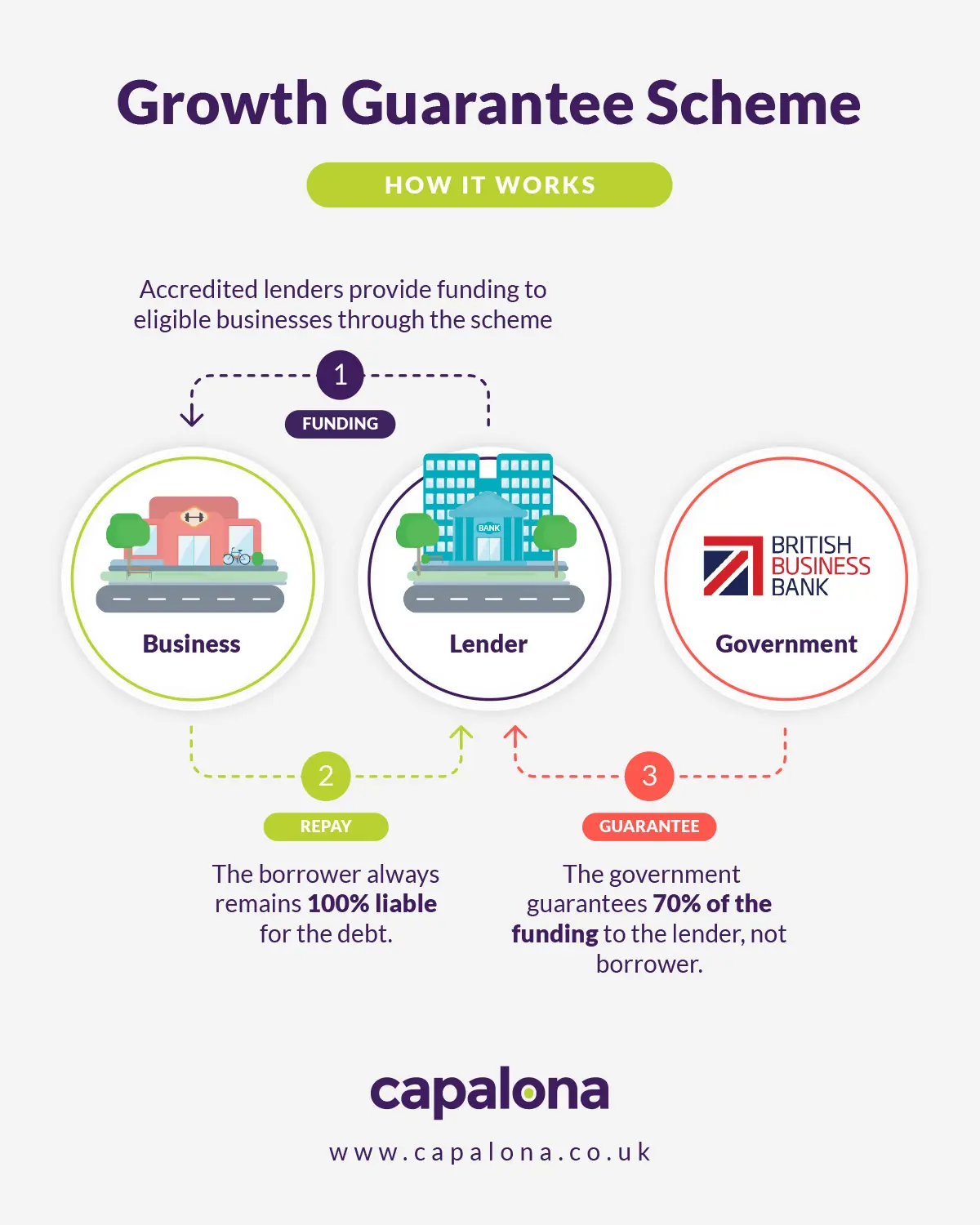

How does the Growth Guarantee Scheme work?

The GGS works by offering financial support to small businesses in the UK. As the scheme is government-funded, accredited lenders receive a 70% guarantee from the government, meaning they can approve even more loan applications and help more businesses.

Businesses can apply for a variety of business loan products, with some loans offering up to six-year repayment terms.

What types of funding are available under the scheme?

Invoice finance

Business owners can apply for invoice finance starting at £1,000 with three-month to three-year terms. This type of finance enables you to unlock cash tied up in unpaid invoices, helping you better manage your cash flow.

Asset finance

Similar to invoice finance, asset finance starts at £1,000 and has a term of three months to six years. It enables the borrower to purchase and use assets without having to pay the full costs upfront.

Term loans

Term loans can also be repaid between three months and six years and starting at £25,001, they can be short, medium, or long-term loans, depending on your circumstances. They are shared as a lump sum and repaid in monthly instalments.

Overdrafts

Overdrafts also start at £25,001 and can be repaid in three months or three years. They offer the perfect opportunity to dip into funds as and when needed.

Always research your options to ensure you choose the right business loan for your needs.

Which accredited lenders are part of the scheme?

The British Business Bank manages the Growth Guarantee Scheme, but borrowers can only get funding from accredited lenders. There are 50 accredited lenders you can apply for the scheme through:

- ABN AMRO Commercial Finance

- Allica Bank

- Arbuthnot Commercial ABL

- Arkle Finance

- ART Business Loans

- Atom Bank

- Bank of Scotland

- Barclays

- BCRS Business Loans Limited

- Big Issue Invest

- BLG Development Finance

- Business Enterprise Fund

- Close Brothers

- Compass Business Finance

- Coventry & Warwickshire Reinvestment Trust

- Danske Bank

- DSL Business Finance

- Enterprise Answers

- Enterprise Loans East Midlands

- Finance For Enterprise Limited

- FSE Group

- Funding Circle

- Genesis Asset Finance

- Haydock Finance Limited

- HSBC

- Investec

- Kingsway Asset Finance Ltd

- Let’s Do Business Finance

- Lloyds Bank

- Momenta Finance

- NatWest

- NEL Fund Managers

- Newable

- Novuna Business Cash Flow

- Paragon Bank

- River Capital

- Robert Owen Community Banking

- Royal Bank of Scotland

- Santander

- Shire Leasing

- Simply Asset Finance

- Skipton Business Finance

- Social Investment Business (SIB) group

- Social Investment Scotland

- South West Investment Group (SWIG)

- Time Finance

- Tower Leasing

- UKSE

- Ulster Bank (Northern Ireland)

- Virgin Money

Simply visit one of these lender’s websites to learn more about their financial offerings and apply. If you’re looking for alternative financing options, we can help you compare business loans in seconds. Get a free quote.

Growth Guarantee Scheme FAQs

Got more questions? Hopefully, these FAQs will answer them.

How do I apply for the GGS?

You can apply by visiting one of the accredited lender websites and navigating to the correct page.

Can I apply for the GGS if I’ve applied for other schemes previously?

Yes, even if you've applied successfully for other past schemes like the Business Interruption Loan Scheme, you can still apply for the Growth Guarantee Scheme.

How much can I borrow?

Businesses can borrow up to £2 million, or £1 million for Northern Ireland Protocol businesses.

Can I sign a personal guarantee?

Some lenders will allow you to sign a personal guarantee. By signing this document, you agree to take personal liability for the debt should your business fail to repay.

Signing this lessens the risk you pose as a borrower but it dramatically increases the risk for you, if you fail to repay, you could lose your personal assets like your family home. This isn't a decision you should take lightly.

What is the term length for GGS loans?

offers repayment options from three months up to six years. However, other products like overdrafts, invoice finance, and asset-based lending offer repayment terms ranging from three months up to three years.

Although lenders are obligated only to lend responsibility, you should always ensure you can comfortably afford repayments within the lender's agreed-upon timeframe.

Am I eligible for the Growth Guarantee Scheme?

To be eligible to apply for the scheme, your business must:

- Not be insolvent or bankrupt

- Have been trading for at least two years

- Have a turnover of less than £45 million

- Be based in the UK

- Have a good credit history or are willing to sign a personal guarantee (if applicable)

Is the GGS available to sole traders and startups?

The GGS is available for various company trading statuses, including sole traders, limited liability partnerships, limited companies, and cooperatives.

If you're a relatively new business and have been trading for less than two years, you might be more suitable to apply for the British Business Bank Start-Up loans, where you can access up to £25,000 to grow your business!

What fees and interest rates will I incur, and when must I start repayments?

Repayment terms and interest rates will be largely lender-dependent, with your circumstances taken into account, too.

Adrian T

5/5

Amazingly fast, efficient service, minimal paperwork. So much faster than my business bank of twelve years.