Merchant Cash Advance

Business finance that is repaid simply via future credit and debit card sales. The quick, unsecured way to raise short-term finance.

- Compare a wide range of lenders and rates

- Check your eligibility in minutes

- Find out how much you could borrow

It's fast, free and won't affect your credit score

- What is a merchant cash advance?

- How does a merchant cash advance work?

- How much could I borrow?

- What is a factor rate?

- Is a merchant cash advance a loan?

- What are the benefits of a merchant cash advance?

- What are the disadvantages of merchant cash advance?

- Do I qualify for a merchant cash advance?

- What if I don’t qualify for a merchant cash advance? What next?

- How can I get a merchant cash advance?

- What can a merchant cash advance be used for?

- Which industries typically use merchant cash advances?

- Why choose Capalona vs. competitors?

Checking won’t affect your credit score

What is a merchant cash advance?

A merchant cash advance, also known as a business cash advance or a PDQ loan, is a short-term, unsecured cash injection loaned against your business’s future credit card and debit sales.

A merchant cash advance is unsecured finance, which means you’re not risking your assets in exchange for funds. It’s a great financial solution for any UK business processing card payments through a merchant gateway facility or a PDQ card machine.

Checking won’t affect your credit score

How does a merchant cash advance work?

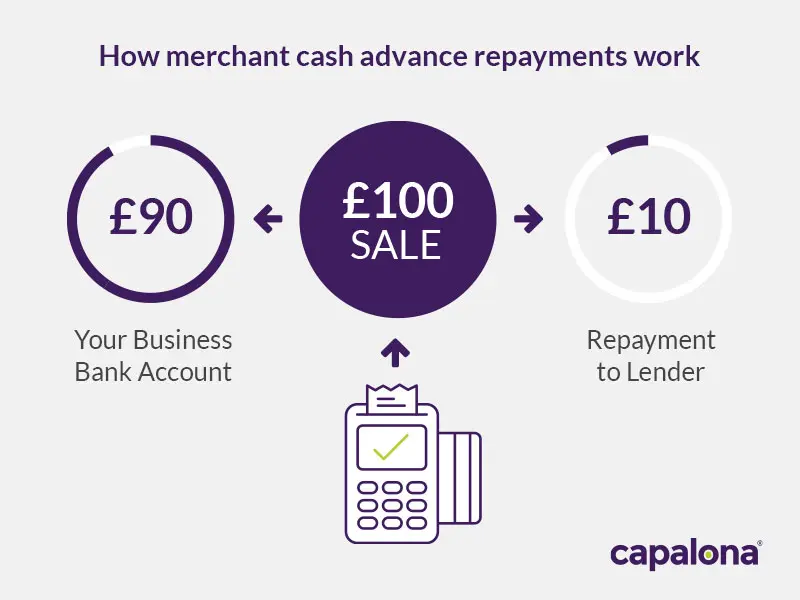

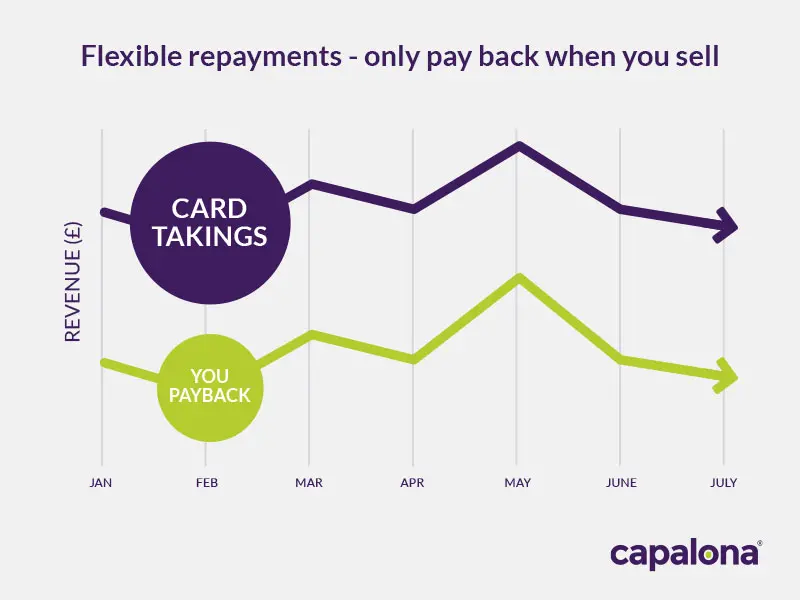

A merchant cash advance for business owners is a flexible and affordable form of funding. Unlike with a traditional unsecured business loan, there are no fixed monthly repayments. Instead, you repay a pre-agreed percentage from each payment you process through your card machine.

The lender will usually advance funds equal to your company’s monthly card sales turnover. When it comes to paying back the money borrowed, an agreed percentage (usually around 10%) is deducted from each of your card sales until the advance is paid off in full.

This type of finance is perfect for small businesses that are seasonal or looking for a more flexible repayment structure.

Merchant cash advance example:

You borrow £2,000 to purchase stock for your retail shop. You agree to repay 10% of every purchase you make through your card machine. A purchase is £100, you would keep £90 and £10 would automatically be repaid to the lender via your merchant bank account.

The lender would continue to subtract 10% from each card payment you process until you repay the cash advance in full.

How much could I borrow?

Most advances range from £2,500 to £500,000. How much you can borrow depends on your monthly card turnover. So the more sales you process, the larger the cash advance.

Use our merchant cash advance calculator to see how much you could borrow and the total repayable amount, including factor rate costs.

Please note: this calculator should only be used as a comparison guide alongside quotes you may already have or as a starting point during your initial research.

Your results

Total loan repayment

£0

Daily average repayment

£0

Repaid in around

0 days

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

Checking won’t affect your credit score

What is a factor rate?

A factor rate is used to calculate how much the cash advance will cost you rather than a traditional interest rate percentage. The factor rate is shown as a decimal figure.

This rate will vary significantly depending on your industry, risk and trading performance. As a guide, you can expect it to range from 1.1 to 1.5.

A factor rate example:

To get the total repayable figure, just multiply the amount you borrow by the factor rate.

So, if you borrow £10,000 and the lender offers you a factor rate of 1.2, your total repayable amount will be £12,000:

£10,000 x 1.20 = £12,000

Is a merchant cash advance a loan?

A merchant cash advance is not a loan. It’s an advance on the money your business is forecasted to make. An advance is essentially you selling future debit and credit card revenue to the lender.

It is sometimes referred to as a card processing loan or a PDQ loan, but it isn’t a loan in the traditional sense.

What are the benefits of a merchant cash advance?

Valued at $17.9 billion in 2023, the merchant cash advance market is one that continues to show significant growth. But, why is this funding solution so popular? Here are ten benefits of a merchant cash advance.

1. Flexible repayments based on future credit and debit card sales:

With an MCA you only repay when you process customer card payments, that means you keep 100% of the money you make through cash sales.

2. Receive fast access to cash for your business:

Lenders can quickly assess your business’s monthly card sales turnover. With high approval rates and quick decisions, you can receive the advance within days, sometimes on the same day of application.

3. No interest charged on money borrowed:

There is no APR, hidden fees or additional charges associated with the borrowing. Instead, the lender will make you aware of the total cost of borrowing based on the agreed-upon factor rate.

4. Lenders consider all business credit ratings:

Lenders don’t base their lending decision solely on company credit score, which means poor credit isn’t always a barrier for an MCA. Instead, you secure funding by granting access to your accounts, basing decisions on business performance.

5. Less risk of defaulting on repayments:

As repayments are automatically taken through your card sales, you don’t need to remember to make monthly payments like with traditional bank loans. Which means you won’t have to shoulder penalty charges or other fees for payment defaults.

6. Business assets are protected:

A merchant cash advance is a type of unsecured funding, so you don’t need to risk business collateral for security. So you can apply for an MCA even if you have limited assets.

7. No business plan required:

Some traditional finance lenders might want to see your business plan, but business cash advance lenders don’t need to. Rather, they’ll look at your merchant statements to verify past card performance, which helps them determine future card sales.

8. Less paperwork and hassle:

Some lenders embrace technology, enabling you to access your merchant account statements digitally via your merchant ID. This speeds up the entire process, saving you time instead of submitting the merchant statements via email or post.

9. Works in line with your cash flow:

If you have a dip in monthly revenue, you don’t have to worry about fixed monthly repayments. By repaying a percentage of your card sales, MCA repayments ebb and flow with your business revenue. This repayment structure takes the financial pressure off business owners.

10. Borrow £2,500 to £500,000:

In some cases, you can qualify for as much as 150% of your monthly card sales. So applying for a merchant cash advance can mean a healthy cash injection to help your business grow quickly.

Checking won’t affect your credit score

What are the disadvantages of merchant cash advance?

There are pros and cons to any business finance solution. But the main disadvantage here is that not every business is eligible for a merchant cash advance. For example, this type of finance isn’t suitable for businesses that don’t take card payments from customers, or for start-ups or businesses with less than three months of card sales.

And if you do take card payments from customers, you need a minimum monthly turnover before a lender approves your application. As a guide, monthly turnover should roughly equal £2,500 per month to qualify.

Some business cash advance lenders might also ask you to transfer to an alternative merchant processor. If this is a requirement, the process is generally managed for you as part of the funding agreement.

Always check the lender’s specific eligibility criteria before applying to avoid disappointment or wasting time.

Do I qualify for a merchant cash advance?

Here are some basic criteria you should meet before applying:

- Accept credit and debit card payments (i.e. have a merchant account)

- Be based in the UK or Ireland

- Be a limited company, partnership or sole trader

- Be trading for at least three months

- Process a minimum of £2,500 in monthly card sales

These requirements mean that start-ups with less trading history and businesses that don’t meet the minimum required card sales may well struggle to obtain this kind of funding.

If you don’t meet the criteria, don’t worry! We have a wide range of other business finance options available for you.

What if I don’t qualify for a merchant cash advance? What next?

If you don’t meet the criteria, don’t worry! We have a wide range of other business finance options available for you. Alternatively, if your circumstances change and you hit the minimum monthly turnover requirement or your business is now older than three months, you can always re-apply.

How can I get a merchant cash advance?

With our free loan comparison tool, applying for a merchant cash advance is easy. Simply fill in our quote form and instantly compare merchant cash advance options. Once you’ve found a lender and offer you like the look of, click through to continue with your application online.

Compare merchant cash advance lenders.

What can a merchant cash advance be used for?

There are no restrictions on how you can use a merchant cash advance in your business. Here are just a few ideas for how you can best use your new working capital:

- Recruit and train new staff

- Purchase stock

- Invest in new equipment

- Refurbish or expand your premises

- Improve your cash flow

- Advertising and marketing

- Cover emergency outgoings, i.e. repairs or unexpected bills

What our experts say

"A merchant cash advance is great for businesses that take card payments from customers and are in need of a quick cash injection. With the benefits of being unsecured and having the payment flexibility that mirrors cash flow, it can be more expensive than other forms of business funding and should be considered as a short-term funding option."

Checking won’t affect your credit score

Which industries typically use merchant cash advances?

As long as you process card payments from customers, a merchant cash advance is suitable for all types of businesses.

- Hospitality sector (restaurants, takeaways etc.)

- Retail shops and convenience stores

- E-commerce stores

- Hotels and B&Bs

- Auto repair shops and MOT service centers

- Salons and Hairdressers

- Other independent retailers

- And more

Why choose Capalona vs. competitors?

We know how precious your time is, we’re business owners, too! We designed our comparison tool to help you save time by helping you quickly find and compare eligible business finance options in one place.

We work with a wide range of merchant cash advance direct lenders and help connect businesses to the right funding products for their needs.

We’re members of the The National Association of Commercial Finance Brokers (NACFB), Federation of Small Businesses (FSB) and Cyber Essentials certified, so we have all the security measures in place to protect your business’s data.

Compare Merchant Cash Advance options today. (Collecting quotes won’t affect your credit score.)

Adrian T

5/5

Amazingly fast, efficient service, minimal paperwork. So much faster than my business bank of twelve years.