Mezzanine Finance

Utilise hybrid debt and equity finance to complete property development, commercial acquisitions and LBOs. Mezzanine loans can help you access capital to accelerate business growth without collateral. Find out more about mezzanine finance in this guide.

- Compare a wide range of lenders and rates

- Check your eligibility in minutes

- Find out how much you could borrow

It's fast, free and won't affect your credit score

- What is mezzanine finance?

- Why is it called mezzanine financing?

- How does mezzanine finance work?

- Mezzanine finance example

- Why use mezzanine financing?

- Using mezzanine finance for property development

- Using mezzanine finance for acquisitions and LBOs

- What are the advantages of mezzanine finance?

- What are the disadvantages of mezzanine finance?

- How much does mezzanine finance cost?

- How risky are mezzanine loans?

- Does my business qualify for mezzanine finance?

- How to select a mezzanine finance provider?

- How do I apply for mezzanine finance?

- Is mezzanine financing right for my business?

What is mezzanine finance?

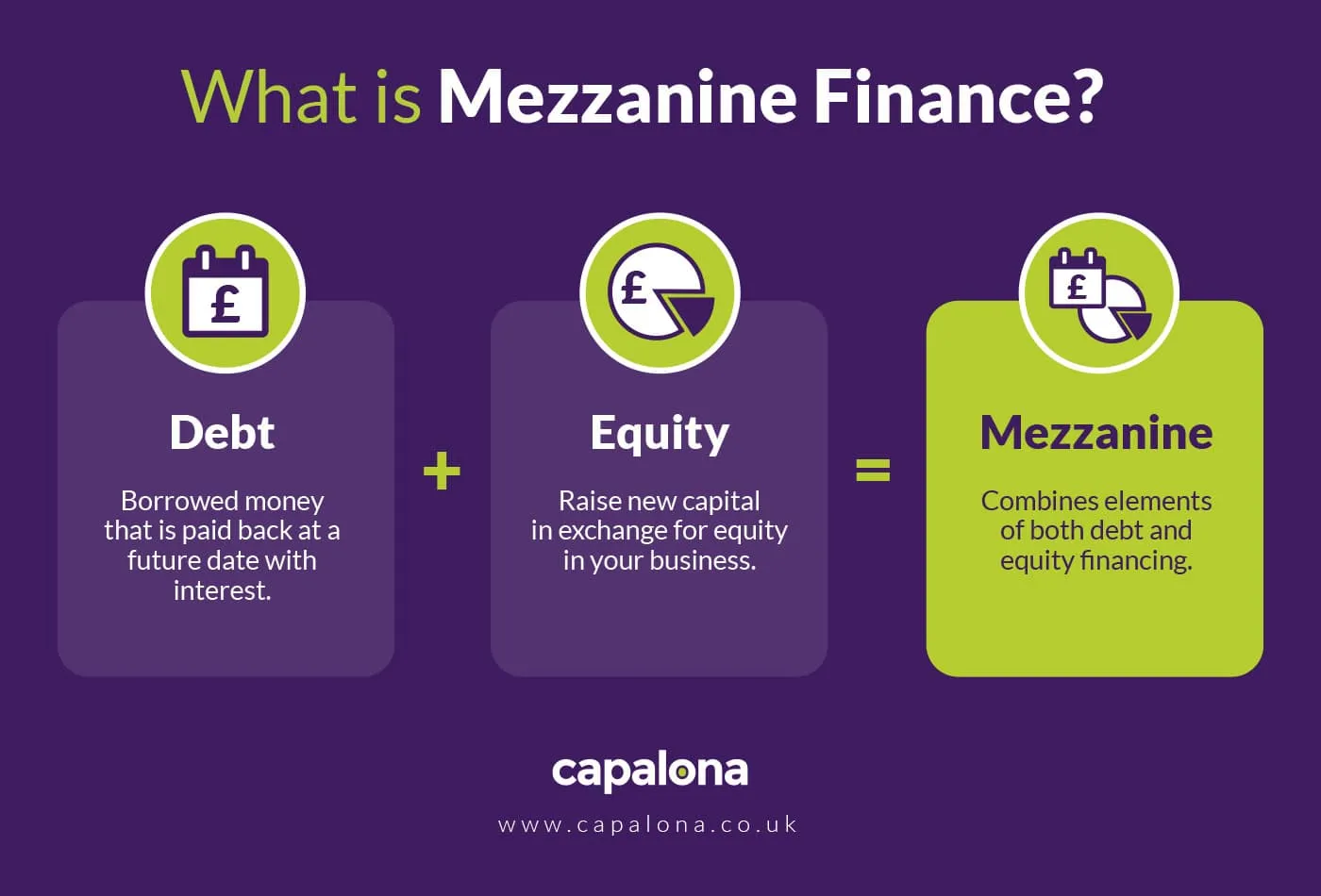

Mezzanine financing is a type of finance that is associated with acquisitions and leveraged buyouts. It is a hybrid form of funding that combines elements of both debt and equity finance. This long-term funding solution can be used to finance large growth ventures and invest in new markets. Although it is a high-risk funding option, it offers businesses with lots of opportunities.

Why is it called mezzanine financing?

Mezzanine is Latin for “of the middle”, so it’s called mezzanine because its risk level falls midway between that of secured loans made by lenders such as banks, and equity. Mezzanine financing is a bit of both, meaning you get access to the capital you need for your project, and if you’re unable to pay it back after a specified period, the debt is converted into equity for the lender.

How does mezzanine finance work?

Mezzanine financing works to fill the gap between debt finance and equity finance. Put simply, it works as a ‘top up’ loan. It falls in the middle of debt and equity finance - while it is senior to equity, it is subordinate to debt.

With mezzanine finance, there is a hierarchy of debt. As the mezzanine financing is subordinate to senior debts, it only gets repaid once the main debt repayments are paid. However, if a business is not able to pay off their debts within the pre-agreed term, their debt gets converted to equity for the lender.

You don’t need collateral to secure this finance. Instead, the lender shoulders the investment, which means they have a genuine interest in how your business performs. The finance contract can include covenants to protect the lender should you become unable to repay the debt, so be aware of these.

What is senior debt?

Debt finance covers the majority of commercial borrowing, such as secured business loans. Senior debt is borrowed money that a business is required to pay back first. It carries a first charge over particular security. As it is ‘senior’, it takes priority over other debts that are also loaned.

In contrast to senior debt, mezzanine debt is partly loan and partly investment, carrying a subordinate charge and more risk. In terms of mezzanine finance’s debt hierarchy, it is structured in the order of:

- Senior debt

- Mezzanine debt

- Preferred and common equity

Mezzanine finance example

You’ve stumbled upon a fantastic property development opportunity, but the cost to acquire it is £7 million. You secured a business loan for £5 million from your bank, and you have an additional £1 million available, but you’re still £1 million short.

You could either back down and let the opportunity pass you by, or you could take advantage of mezzanine financing. With the finance in place for the extra £1 million, you’ll all set to move forward with your investment.

If you’re unable to repay the mezzanine debt, it can convert to equity for the lender.

If you’re unable to secure a bank loan, due to lack of collateral, you can use mezzanine finance as your primary source of funding.

Why use mezzanine financing?

Mezzanine finance is typically used as supplementary finance after the initial majority investment has been agreed upon. It’s a long-term funding solution, and because you don’t usually pay it back in monthly instalments, it can help improve your cash flow in the interim. This type of financing can help you grow your business quickly, enabling you to easily build new premises or invest in new markets.

Mezzanine finance helps you invest a lot of money, allowing for better returns.

What else can you use mezzanine finance for?

- Management and shareholder buyouts

- Acquisitions

- Restructuring of balance sheet

- Growth capital

Using mezzanine finance for property development

Mezzanine finance is commonly used by property developers to ‘bridge the gap’ between the amount of money they have to invest, and the development finance provided by a lender. Mezzanine lenders take a second charge on the development, which is junior to the senior debt provided by the development finance lender.

When it comes to property development, mezzanine finance lenders are usually able to cover up to 90% of the project. They provide property developers with a solution, keeping upfront costs low.

Using mezzanine finance for acquisitions and LBOs

As well as being used in property development, mezzanine finance also gets used during commercial acquisitions and leveraged buyouts (LBOs). The premise is the same as with property development, the main difference being that a business is being financed rather than a property or specific asset.

What are the advantages of mezzanine finance?

Mezzanine finance is a funding solution that offers numerous benefits to businesses. Mezzanine loans have helped many borrowers take that next step towards business growth, supporting large scale development and commercial real estate acquisition. There are lots of advantages to using mezzanine financing:

- Improve cash flow

- Grow your business quickly

- Enhance return on equity

- Borrow more money with mezzanine finance than a bank loan

- Low-cost alternative to raising equity

- Long-term capital

- Access large amounts of funds

- Flexible arrangements

- Tax deductible in some cases

Does mezzanine finance sound like a good fit?

What are the disadvantages of mezzanine finance?

What are the cons of using mezzanine finance? As with any business finance solution, mezzanine finance comes with its own risks. The most important disadvantages of mezzanine financing to be aware of are:

- Lender will own shares in your business should you be unable to repay

- Agreement could include restrictive covenants

- More expensive than senior debt and traditional finance

- Lengthy form of finance that can take months to be arranged

How much does mezzanine finance cost?

Usually, when arranging mezzanine finance, you can expect to pay a facility fee, an interest rate and sometimes an exit fee for your mezzanine finance. Most mezzanine lenders price on a per-project basis.

Due to the fact mezzanine finance is high-risk, the interest rates charged tend to be higher than for other types of business finance. For mezzanine loans, interest rates usually range between 10 - 20%, but be advised that they can be higher than that if there is significant risk.

Just as with any business finance, the associated costs depend heavily on the provider you choose, how much you decide to borrow, your business circumstances and the project you’re funding.

When it comes to repaying your mezzanine loan, payment structures can be flexibly arranged on a monthly, quarterly or annual basis.

How risky are mezzanine loans?

Mezzanine loans are one of the highest-risk types of business borrowing, but because of this they are able to offer high yields and unparalleled benefits. Mezzanine loans have high Loan-to-Value (LTV), which makes them more expensive than senior loans. When borrowing, it’s important to remember that you take on complete liability for the agreed debt.

As mezzanine loans require a personal guarantee, in the event your business fails to repay, you will become personally liable.

Does my business qualify for mezzanine finance?

A mezzanine finance arrangement is usually sourced for large projects with a high element of associated risk, such as a new acquisition or a move into new markets. If your business has not been able to secure enough funds via other loan arrangements, mezzanine finance could offer the right solution for your business and future objectives.

When it comes to qualifying for mezzanine finance, mezzanine debt lenders will closely analyse your business’s earnings before interest, taxes, depreciation and amortization (EBITDA) and gross margin percentage.

Mezzanine finance can be used for both residential and commercial real estate development projects; however, a personal guarantee will be required. Bear in mind that mezzanine financing is risky, therefore it is better suited to experienced property developers. Lenders will want to see a prior track record of successful lending.

How to select a mezzanine finance provider?

Selecting a mezzanine finance provider isn’t like choosing a traditional loan lender. As the providers are interested in your long-term business strategy, you must select a mezzanine finance provider that you can build a trusting relationship with.

You need a mezzanine finance provider who shows interest in your business and its functionality. You’re looking for a partner rather than a lender — a partner who understands your business goals.

Luckily, at Capalona, we work with a panel of trusted UK mezzanine loan providers. Our online business finance platform lets you compare to find the best mezzanine financing provider for your needs.

How do I apply for mezzanine finance?

Applying for mezzanine financing is quick and easy. Simply fill in this short online application form to get started. All we need to know is a few basic details such as the legal status of your business, what you need the mezzanine loan for and how much funding you require.

As a broker, our sole purpose is to match you with the best funding solutions for your UK business. It only takes a few minutes to apply.

Is mezzanine financing right for my business?

It’s important to note that mezzanine finance is not the solution for every type of business and scenario. Mezzanine finance lenders will approve applications case by case, usually analysing:

- Your business’s EBITDA

- Experience in the industry, proven track record necessary

- Planning permission that has already been granted

- First charge funding plans with evidence provided

If mezzanine finance isn’t right for your UK business, don’t worry! Check out our other business funding solutions.

Adrian T

5/5

Amazingly fast, efficient service, minimal paperwork. So much faster than my business bank of twelve years.