Supply Chain Finance

Supply chain finance is a funding solution that helps optimise cash flow, reduce risk and strengthen relationships between suppliers and buyers in the supply chain.

- Compare a wide range of lenders and rates

- Check your eligibility in minutes

- Find out how much you could borrow

It's fast, free and won't affect your credit score

What is supply chain finance?

Supply chain finance, also known as reverse factoring, is a funding solution where a third-party funder (a bank or alternative finance provider) pays the supplier's invoice early and extends payment terms for the buyer.

This finance is put in place by the buyer to help manage cash flow, improve supplier relationships, and ensure continued stock supplies — which ultimately reduces the risk for both buyer and seller.

Supply chain finance gives the buyer ultimate flexibility when paying supplier invoices.

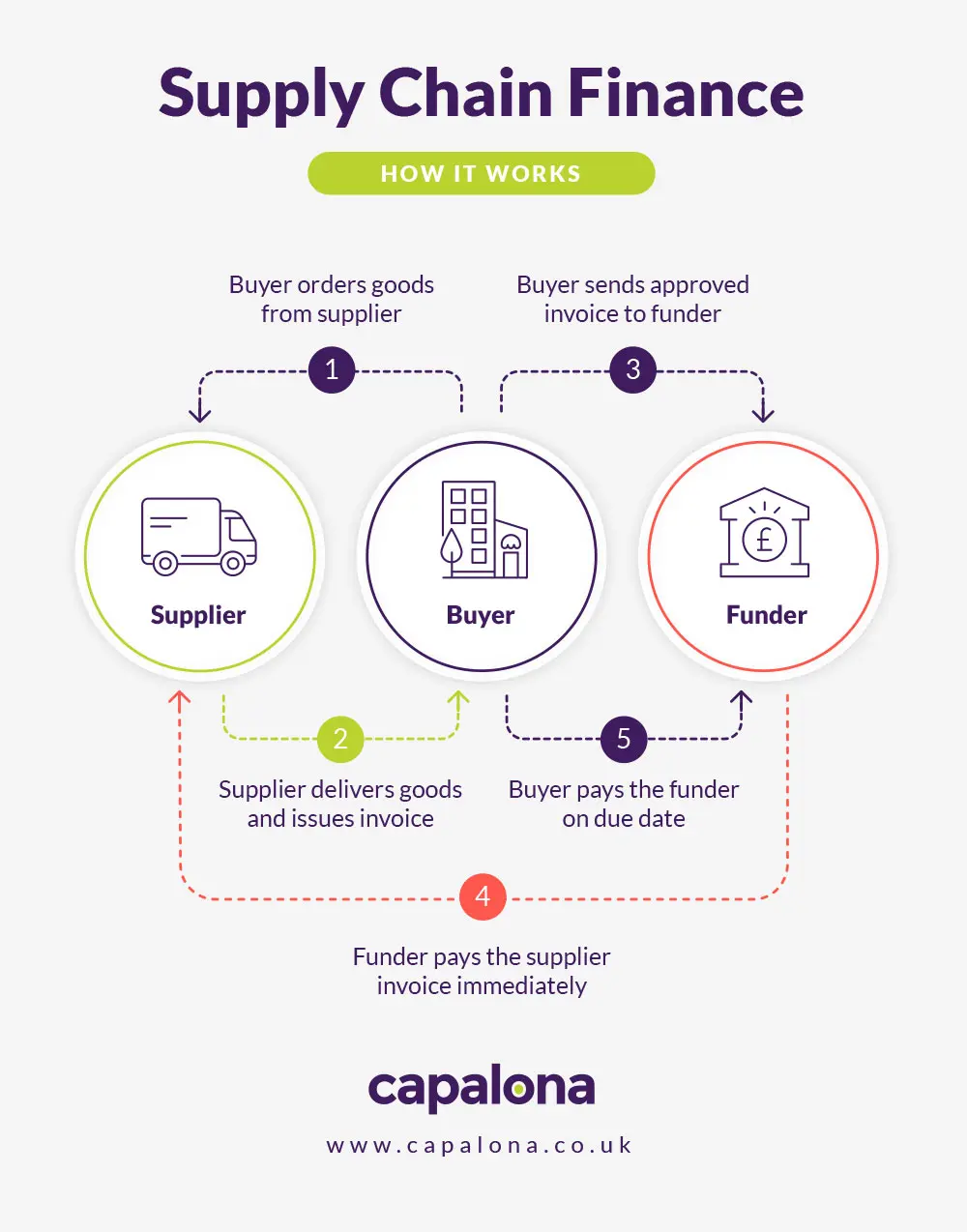

How does supply chain finance work?

A cloud-based platform is used in supply chain finance, accessible by both the buyer, seller and the financial institution offering the finance. The supplier uploads its invoice to the platform, the invoice is then approved by the buyer.

The financier then pays the invoices and the buyer adheres to the payment terms previously agreed upon with the financier.

Engaging a lender offering a supply chain finance solution means the supplier receives the invoice payment in full without waiting for the standard 30-day payment period. And the buyer gets a longer period to pay the invoice. Both the buyer and seller benefit from supply chain financing.

With the buyer delaying invoice payment, they keep money in their business for longer. And the seller gets paid immediately, which means a healthier, more predictable cash flow for them.

Supply chain finance example

Let’s say a sweet shop wants to re-stock its shelves, they approach their sweet supplier and place a large order. The sweet supplier gets their order ready as usual, ships the order, and raises an invoice for the sale.

Instead of the sweet shop processing and paying the invoice within their typical terms i.e. 30 days, they receive an extended payment term from the supply chain finance lender.

The lender then pays the invoice amount in full on the sweet shop’s behalf. So the supplier receives the invoice amount immediately, rather than waiting until the invoice is due.

Benefits of supply chain finance

- Longer payment terms for the buyer - Extended payment terms mean one thing — more money in the business for longer. This helps the buyer with budgeting and forecasting, without putting unnecessary pressure on the supplier.

- The buyer can reduce supply chain disruption - With the supplier receiving payment quickly, the buyer helps keep them in business, which means no distribution to the supply chain and the buyer can stock up without worry.

- More predictable cash flow for the supplier - Not having to wait a 30-day term for payment means the supplier can enjoy a more predictable cash flow.

- Build better supplier relationships - More predictable cash flow for the supplier can help improve the buyer’s relationship with the supplier. They have confidence they’ll pay the invoice each time, making the buyer favourable.

- SCF is lower-cost financing - Supply chain finance is usually lower cost than other forms of business finance such as unsecured business loans. This is because the finance is based on the buyer's credit rating. If the buyer has a good credit score then supply chain finance could be a more cost-effective funding source.

The difference between supply chain finance and trade finance

Although both supply chain finance and trade finance help businesses buy stock and inventory from their supplier, they differ. Trade finance is funding used by buyers to help them buy stock from a supplier to fulfil a purchase order.

Equipped with a purchase order, a trade finance company can buy the stock from the supplier directly. The business will pay the finance company for the goods once the purchase order has been fulfilled. This means the buyer can grow their business without ever being out of pocket when purchasing stock in large quantities.

How to apply for supply chain finance

You can apply for supply chain finance directly through the lender's website. But to ensure you're getting the best deal, you're always best comparing your options.

We’re brokers, which means our business finance comparison tool is 100% free for you to use. There’s no obligation to proceed with any of the quotes presented to you.

Why use Capalona to compare supply chain finance?

Our tool is quick and easy to use, simply input a few details about what you’re looking for and we'll show you a variety of options for you to compare and learn more about.

We work with a panel of trusted UK lenders offering flexible business finance solutions to suit your specific business needs. Compare supply chain finance.

Adrian T

5/5

Amazingly fast, efficient service, minimal paperwork. So much faster than my business bank of twelve years.