Unsecured Business Loans

Unsecured business loans offer greater flexibility for small and growing businesses that want to access finance without offering an asset, such as property or collateral, as security for the loan.

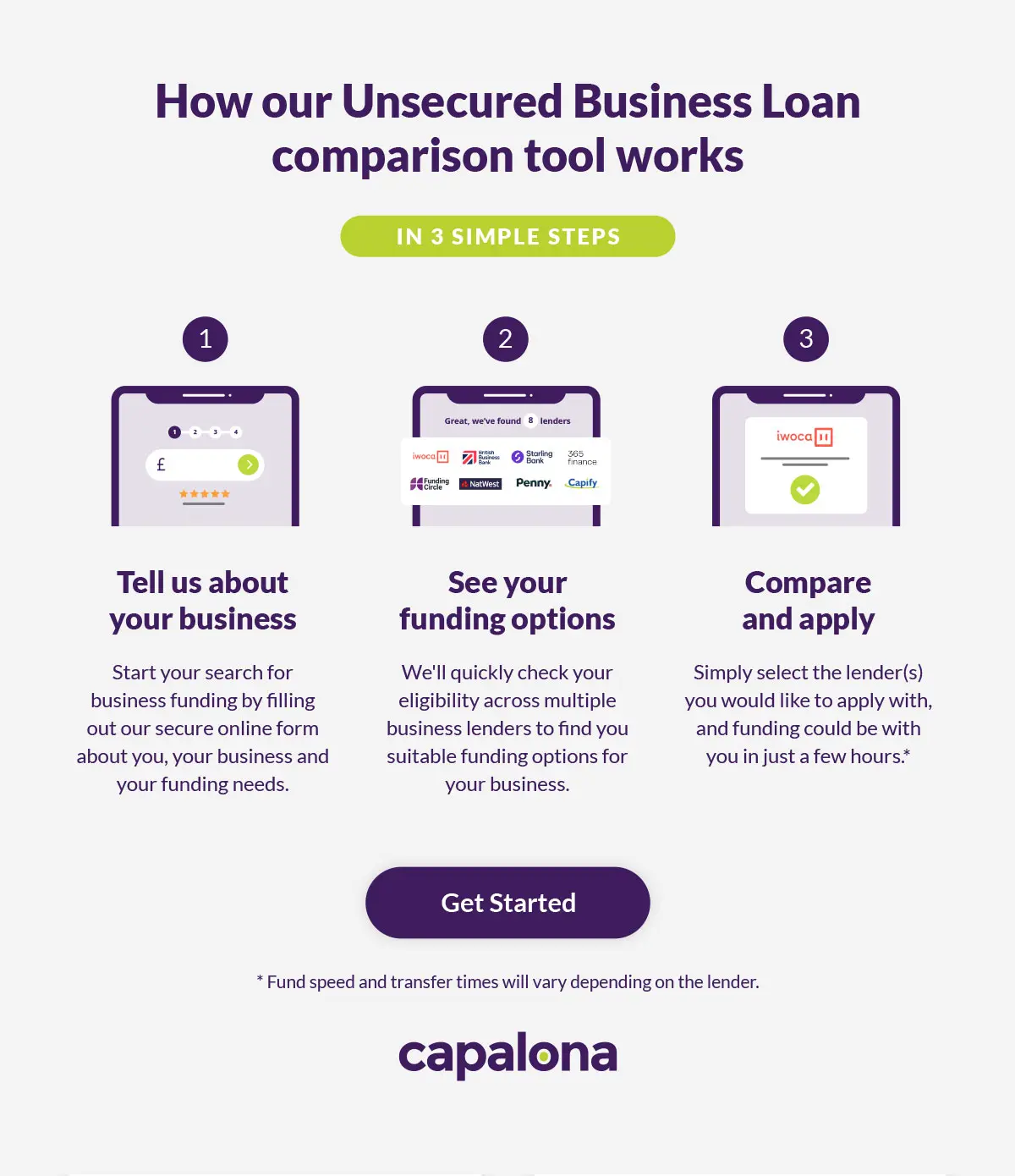

- Compare a wide range of lenders and rates

- Check your eligibility in minutes

- Find out how much you could borrow

It's fast, free and won't affect your credit score

- What is an unsecured business loan?

- Types of unsecured business loans

- How do unsecured business loans work?

- What is the difference between secured and unsecured business loans?

- What are the advantages of unsecured business loans?

- What are the disadvantages of unsecured business loans?

- Does my business qualify for an unsecured business loan?

- Is a personal guarantee required for an unsecured business loan?

- How to get an unsecured business loan

- Can I compare unsecured business loan interest rates?

- Unsecured business loan calculator

- FAQs for Unsecured Business Finance

What is an unsecured business loan?

An unsecured business loan is a type of finance that does not require the borrower to provide security. Because the loan is ‘unsecured’, businesses aren’t at risk of losing valuable business equipment, property or land when they choose this funding route.

Unsecured business loans offer a straightforward funding solution for UK businesses. You could borrow up to £500,000 without having to secure the loan against important company assets.

A business loan without security provides a flexible source of funding for businesses that lack assets or do not want to secure them against a loan. You can access finance often within a couple of hours – and simply pay it back within an agreed timeframe.

Types of unsecured business loans

We have various unsecured business loan options to help businesses of all sizes. We offer the following unsecured business finance options:

- Startup business loans - This is great if you are about to start your new business venture.

- Sole Trader Loans - Great if you are set up as a sole trader, we have various lenders who can help sole traders.

- Self employed loans - We have a variety of lenders who can provide loans for a self-employed person.

- Limited company loans - If you are registered with companies house, we can help your limited company get the finance it needs to grow.

- SME business loans - If your small or medium-sized business is trading, we can help you with your business finance requirements.

How do unsecured business loans work?

Unsecured business loans work by providing your business with upfront capital without requiring security. An unsecured business loan has a straightforward repayment structure. You borrow money from a lender after agreeing to make fixed monthly payments at a pre-agreed interest rate. Payments are made over the loan term, until the borrowed amount has been paid back in full. With unsecured loans, interest rates can be higher. There is a wide selection of unsecured business loans for UK firms that offer flexible terms.

What is the difference between secured and unsecured business loans?

Unsecured business loans aren’t backed by any assets. Because of this, they pose a greater risk for the lender, and higher interest rates are usually charged. In contrast, secured business loans are financial products that require businesses to offer up collateral as part of the borrowing agreement.

Unsecured vs Secured Business Loans for Small Businesses

As a general rule, smaller businesses tend to have fewer assets available to offer to lenders. This means that small business loans tend to be unsecured.

However, this does not mean that a small business with adequate assets available, such as property, cannot obtain a secured business loan. If you do want to get a secured business loan, be aware of your current and predicted cash flow, and the level of risk you’re taking if you do become unable to repay your loan on time.

What are the advantages of unsecured business loans?

There are so many benefits to choosing unsecured business finance. If you need a quick injection of cash for your business without offering the security of an asset, an unsecured business loan could offer the flexible and easy funding solution you’ve been looking for. The pros of unsecured business loans include:

- Borrow £1,000 up to £500,000 +

- Does not require any asset security

- Flexible repayment terms from 1 month to 5 years +

- Minimal paperwork required

- Funds can be released shortly after approval

- Short to medium term lending solution

- Keep your company assets safe

Unsecured business loans offer great advantages for businesses operating in the UK. Both well-established businesses and relatively new ventures can enjoy a number of significant benefits.

What are the disadvantages of unsecured business loans?

The main disadvantage of unsecured business loans is that they usually come with higher interest rates. As there’s no collateral or assets to back the loan, lenders take on more risk, so they charge higher rates to cover that uncertainty.

Unsecured business loans also typically have shorter repayment periods than the secured alternative, and you may not be able to borrow as much as if you had assets to secure your loan against.

With Capalona’s comparison tool, we can help you find an unsecured loan with the best interest rates, borrowing amount, and repayment schedule to suit your needs.

Does my business qualify for an unsecured business loan?

To be eligible for a UK unsecured business loan, you must have been trading for at least 3 months and have a minimum annual turnover of £10,000. There are unsecured loan options for sole traders too.

It is worth noting that although you will not need to secure your loan against a personal or company asset, you may be required to have a good personal and business credit history.

- Operating for at least 3 months

- Have a UK bank account

- Limited company, limited liability partnership (LLP) or sole traders registered in the UK

- Annual turnover of at least £10,000

A personal guarantee may also be required, but this could enable you to secure higher levels of funding. If your situation changes and your business is unable to repay the loan, the personal guarantor may be required to pay back the remaining balance under the agreed terms.

If you do not meet these criteria, we can still help you access the finance you need. We offer a wide range of other business finance options and can help you find the right funding solution for your business.

Is a personal guarantee required for an unsecured business loan?

Possibly. A personal guarantee is a legal agreement made by the business owner or director who becomes personally liable for paying any debt should the business be in the unfortunate position of not being able to repay the loan.

The owner or director becomes the ‘guarantor’. It can be made with or without supported security such as a legal charge on the guarantor’s personal property.

A PG can differ between lenders. Some will insist on a PG with supporting security while others may not - it’s good to discuss the terms of any arrangement if they are required to secure the business finance.

Limited companies and LLP’s - If your business is a limited liability partnership (LLP), many lenders will expect you to provide a PG. Any stakeholders and directors with a minimum of 20% - 25% stake in the limited business may be expected to provide a PG.

Sole traders and partnerships - Business owners who are classed as sole traders or partnerships with unlimited liability will invariably be personally liable. The funding will be based on the personal credit history of the business owner.

How to get an unsecured business loan

From all of our trusted lenders, getting a business loan that is unsecured involves a straightforward application process, typically simpler than the process of getting a secured business loan, as you do not need to detail or prove the value of your assets.

A typical application process involves the below;

- Providing company and financial information, including your credit score, cash flow and any existing debts if you have them.

- The lender you choose will then be able to decide whether you are suitable for their unsecured commercial funding.

- You will be asked further information such as how much you wish to borrow, and how long you need this funding for.

- If successful, you may be offered with one or multiple options for unsecured loans with differing repayment terms and interest rates.

Can I compare unsecured business loan interest rates?

Comparing loan rates is a fundamental part of getting the right deal for your business. But it doesn’t just revolve around the best figures. There are differences between secured and unsecured business loans, with each having advantages and disadvantages to consider.

Sometimes the benefits of a particular type of business loan product can outweigh other products based on repayment values. Take, for example, a traditional business bank loan which can be expensive and involve a relatively slow administration process. You may find that an unsecured business loan from an alternative lender will present you with the funds sooner, less paperwork and innovative repayment options. This is why it is always important to compare unsecured business loans.

At Capalona, we know how much time it can take to compare business loan products, lenders and rates. We work to streamline this process, helping to do the hard work for you and find the best loan product for your business. We’ve also created a handy calculator to help you work out how much you could expect to repay. Please take a look at our business loans calculator for more information.

What our experts say

"Unsecured business finance is great for businesses that need to access smaller amounts of cash quickly, especially if they have not got any assets to secure against.

We’ve helped many businesses find the capital they need to grow. Including Theme Parks, Restaurants, Factories, E-commerce websites, Cafés, Fitness Centres, Hotels and music studios - you can see how varied it can be. There are very few businesses that are not considered for this type of funding."

Unsecured business loan calculator

Our unsecured business finance calculator allows you to calculate the total repayable amount on a business loan that you already have received quotes for or you can use it as a guide to working out repayment options before looking for business finance quotes.

Your loan details

%

Your results

Monthly Payments

£0

Total Interest

£0

Avg. Monthly Interest

£0

Total Cost of Finance

£0

This calculator is intended for illustration purposes only and exact payment terms should be agreed with a lender before taking out a loan.

FAQs for Unsecured Business Finance

Here you will find answers to some of the most commonly asked questions about unsecured business loans.

Provided it is for business and not personal use, you can use an unsecured business loan for whatever you need - whether this be new equipment, growing your team, or simply to get your business set up and started.

When applying for unsecured business loans in the UK, there are certain documents that you need to provide. These documents vary from lender to lender, but as a general rule of thumb you should be ready to present:

- Proof of identity and address

- Business verification documents

- Supporting documents (business bank statements)

- Personal guarantee (if required for your unsecured loan agreement)

Unsecured business loans are usually easier to arrange than secured loans, and full approval can be expected within just a few days. In most cases, you can receive funding on the same day as submitting your loan application.

Unlike unsecured funding, secured loans tend to take longer to arrange. This is because an independent valuation of the asset you’re putting forward as security needs to be arranged and this can take time. However, with unsecured loans, faster funding is guaranteed. A lot of the finance solutions we arrange end up being same day business loans.

Many lenders are regulated by the FCA (The Financial Conduct Authority). The FCA also regulates Capalona within the business finance sector. Some business loan products can fall outside the regulatory scope and are not regulated.

We only partner with professional lenders who observe best practices, many of whom are governed by the FCA and are part of trade associations such as the NACFB (National Association of Commercial Finance Brokers.)

You could borrow up to £500,000 with an unsecured business loan. This is without the need to secure the loan against assets.

Yes it is possible to get an unsecured business loan with bad credit, however the lender might require you to sign a personal guarantee to lower the risk.

If you are able to take out unsecured business funding and repay this loan in full as per your lender’s agreement, this is unlikely to hurt your business’ credit score and in some cases could improve it. However, if you fail to meet your payments on time, this could in turn hinder your credit scoring.

As long as you have chosen a reputable lender, unsecured business loans are a safe way to get shorter-term funding without risking the loss of an important asset. At Capalona, we only work with trusted lenders, so by using our comparison tool you are able to take out a loan from a safe loan provider.

Yes, startup loans are commonly unsecured, as new business owners may not have an asset to secure against the loan.

Depending on your loan provider, and the amount you have borrowed, your lender could expect you to repay your loan within any amount of time from 1 month to over 5 years’ time. This is something you will decide before taking out your loan.

Adrian T

5/5

Amazingly fast, efficient service, minimal paperwork. So much faster than my business bank of twelve years.